Good News/Bad News

Share This Insight

How rising wages shook the market, and how to respond.

We recently experienced a rapid stock market correction. This rush of volatility came after a year of unusually smooth market activity, and left investors wondering if they might need to change their investment strategy in response. The short answer for most investors is “No.” If you maintain a diversified portfolio as determined by a financial plan, it is most likely best to stay the course.

Even if you do not need to adjust your investment plan or portfolio, you may still wonder what caused the correction, and how might it change expectations for the future. We never know exactly what causes sudden market moves. Stock prices are determined by millions of investors and computers buying and selling based on a myriad of conflicting philosophies, timelines and priorities. That being said, during this most recent correction, new information emerged that may have triggered concerns among investors.

Wages & Inflation

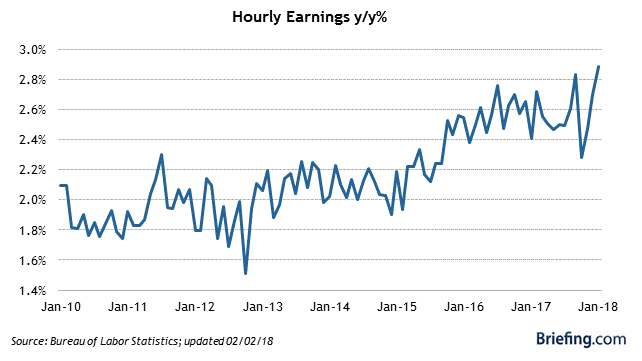

Until this point in the economic recovery, we experienced below average inflation. In fact, inflation was so low that the Federal Reserve often expressed concern about deflation. What is the primary driver of inflation? Wage growth. Wage growth suddenly accelerated in the payroll report issued by the Bureau of Labor Statistics on February 2nd. Accelerating wage growth resulted in a sudden concern about inflation. Rising pay is great news for working Americans, but it could have the side effect of increased costs of goods and services.

Federal Reserve

The Federal Reserve has the difficult task of maintaining 2% inflation and full employment. By changing interest rates, the Fed can increase or decrease the rate of economic activity to meet these goals. During times of high inflation, the Fed will raise short-term interest rates to slow economic expansion and, in turn, decrease inflation. Investors know this about the Fed and, therefore, responded to the news of rising wages in this manner:

Rising wages ⇾ Fed raising rates ⇾ Economic slowdown ⇾ Decreased earnings ⇾ Lower future stock prices ⇾ Sell stocks now

With the emergence of rapid algorithmic trading, this series of responses happened in seconds, and trades settled before most people even got the news about rising wages.

Expectations

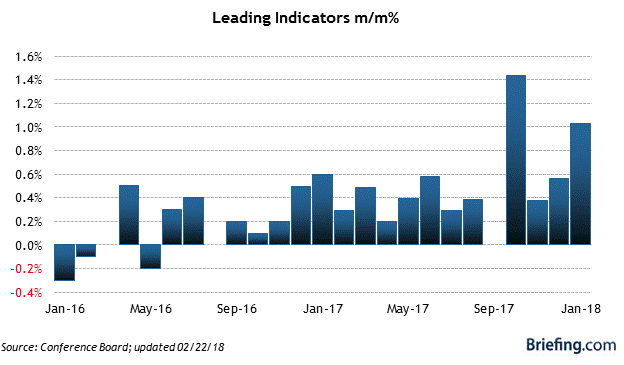

If you step back from the recent correction and look beyond short-term fears about inflation, a very positive picture emerges. Positive data is seen in the Leading Economic Indicators report. Leading Economic Indicators are selected economic statistics that have proven valuable as a group in estimating the direction and magnitude of economic change. The report aggregates ten key, forward-looking economic factors and assigns a score. In the most recent report, issued on February 22nd, all ten indicators were positive. For the fourth quarter in a row, we see a positive score and the overall measure reaches a new high. When the Leading Indicators show new highs, we have historically experienced economic expansion for a four-year minimum. The past cannot always predict the future, but reports like this indicate the economic expansion has room to run.

We can learn a lot from the first two months of 2018. Economic data is unpredictable. Market sentiment changes quickly. Volatility may diminish for a time, but always returns. Market timing is extremely difficult. Most importantly, we have a huge advantage as long-term investors. Rather than trying to predict short-term economic data and the market’s response, a long-term investor can stand back from the noise and experience the benefits of a growing economy.

The information provided has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Brian Cochran and not necessarily those of Raymond James. The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.