Looking Up During Market Downturn

Share This Insight

“You must be busy” is a comment I hear a lot whenever we see market volatility. People assume our office becomes a hub for panic and fear during market downturns. This is far from the truth. The families we serve tend to be wise and patient investors who have experienced market volatility in their investing lifetime. Over the last two weeks, my team has received a mere handful of calls or emails related to the markets, including a few who are anxious to get cash invested. Our advisors and investment committee remain levelheaded when the markets get choppy. We rely on data and lessons from market history when speaking with the few clients who need reassurance. Here are some key facts to keep in mind during this correction:

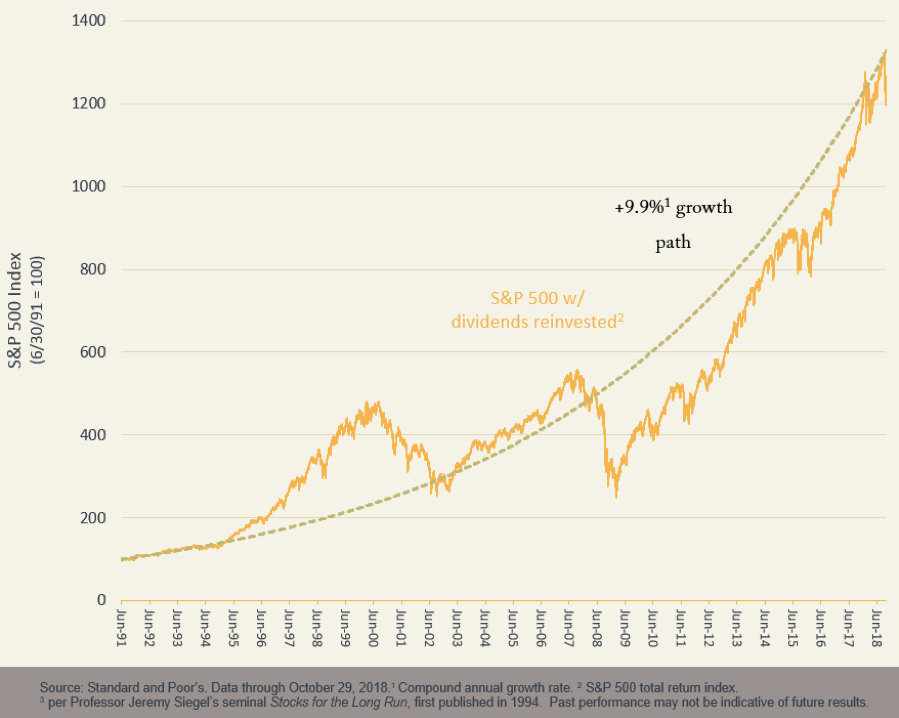

- Markets have moved from slightly above the long-term trend to meaningfully below it. This doesn’t mean that markets can’t drop further, but I would rather be a buyer than a seller when markets are below trend.

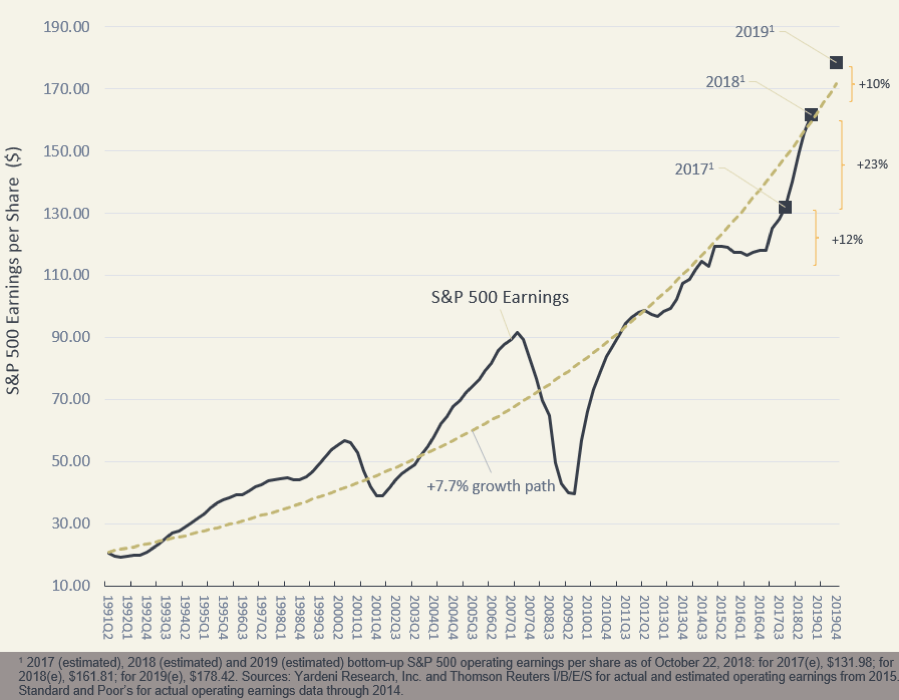

- Corporate earnings are on the rise. Most companies are beating expectations for last quarter’s profits, but some are offering lower-than-expected growth projections for next quarter and early 2019.

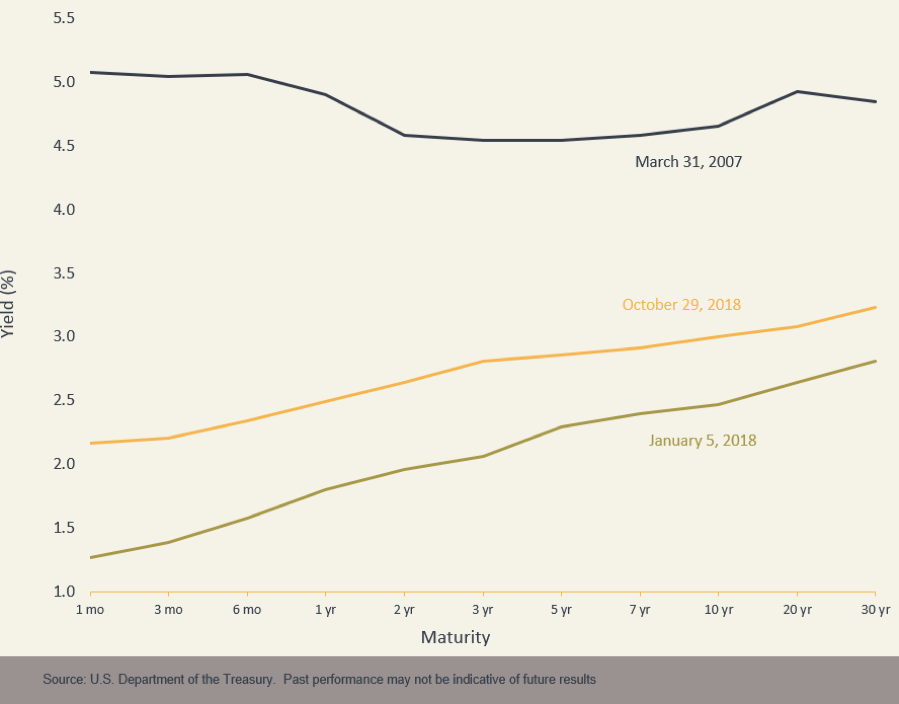

- The Federal Reserve is raising rates but the yield curve is not flat or inverted. Investors follow the yield curve closely, as it has historically served as a reliable warning sign for recessions.

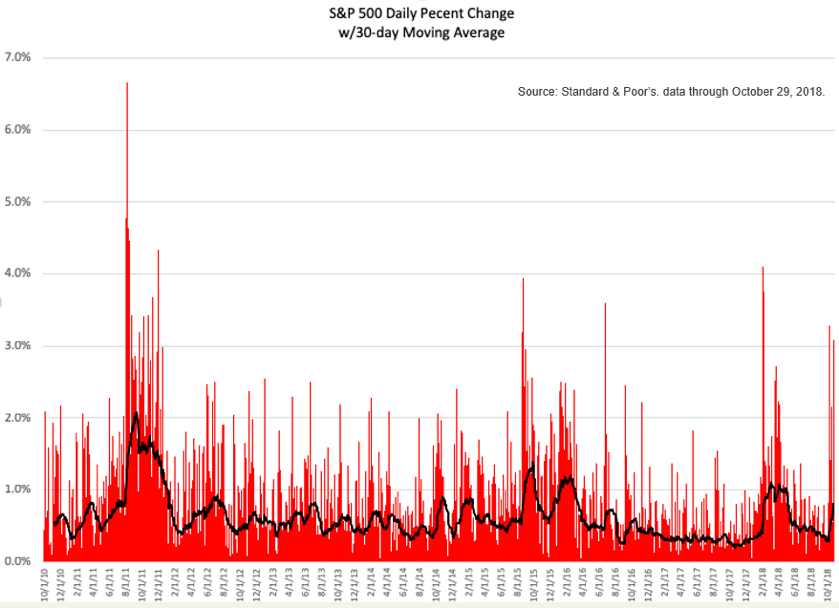

- Volatility is up significantly. However, we are not at levels seen during the last few corrections.

- Bonds are holding their ground and serving their role as a “shock absorber” during a time of short-term stock volatility.

We reserve the right to learn something new and change our opinion, but this looks like an average correction so far. Emotions around politics seem to be adding fuel to the fire. Thankfully, the numbers tell a more positive story than the headlines. This could end up being just another period of noise and a buying opportunity for the long-term investor.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Brian Cochran and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

Bond prices and yields are subject to change based upon market conditions and availability.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.