4 Thoughts on the Yield Curve

Share This Insight

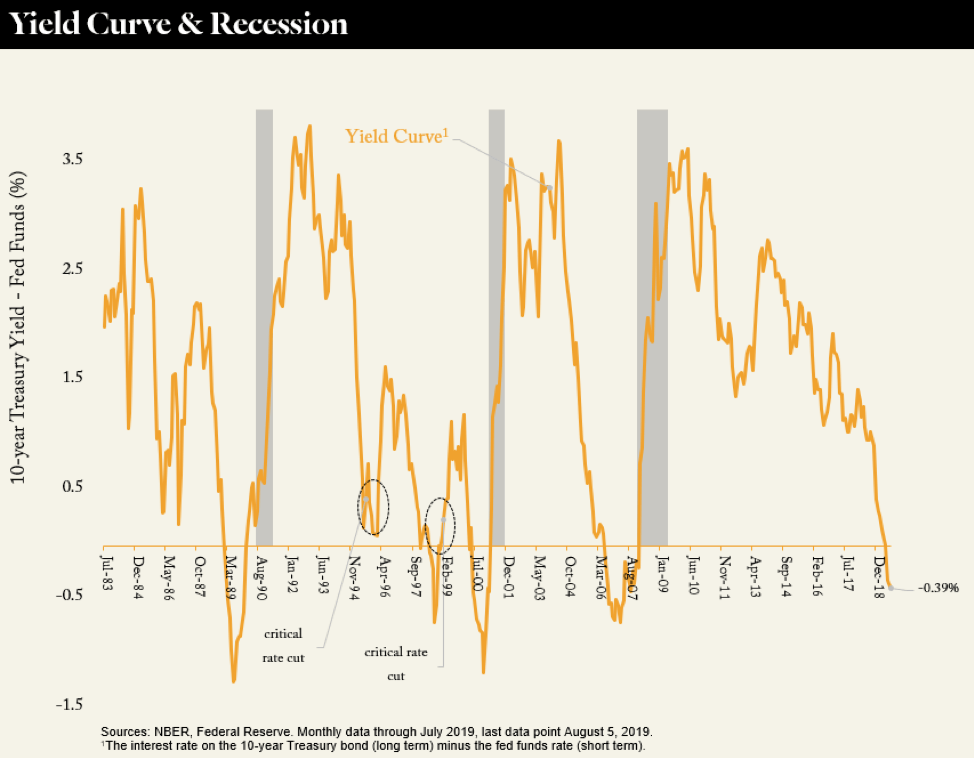

You may have seen the big news that the 2 year/10 year yield curve inverted on August 13th. This interest rate activity, and the 3% stock market drop that accompanied it, were meaningful enough to make it out of the financial news cycle and into the main stream.

The Albuquerque Journal felt it warranted an all-caps headline on the front page. The DJ on my local alternative rock station took a break from his weed and fart jokes to talk about the looming recession. Your plumber probably brought it up. Everyone knows the yield curve inverted thanks to the modern speed of news.

You might be wondering what might happen next and how to respond. Rather than try to predict the future, I will share a few factors that you should consider before making any changes to your long-term investments or financial plan.

- An inverted yield curve has preceded every recession since the ‘50s, but it does not mean growth has stopped. Some people are already talking about "this recession." We are certainly not in a recession today. A recession is generally defined as two quarters of negative GDP. GDP grew at a rate of over 2% last quarter, we have 7 million job openings, the unemployment rate is less than 4%, wages are growing and retail sales are increasing. The economy and stock market have historically grown for another year after a yield curve inversion with average returns in the double digits. Do not use the yield curve to time markets. (If you changed your portfolio this week because of the yield curve, you are market timing!)

- Everyone may know the curve inverted, but nobody knows what will happen next.This inversion may not stick around long. In fact, the inversion that panicked the markets on Tuesday reversed course by Wednesday. Trends can change and the future is always uncertain. The yield curve reversed course twice during the economic boom of the late ‘90s and allowed for continued economic growth.

- Long-term investors can ignore the yield curve just like every other short-term factor. Stocks have returned over 9% over the long term, including periods of inverted yield curve and recession. Trying to time these events in the hopes of achieving a higher return often results in lost returns from failed market timing, increased transaction costs and additional taxes.

- Some may want to see a recession for political reasons. The possibility of a recession could be exaggerated for political gain. Some media personalities have expressed an outright desire for a recession and they are not alone in this sentiment. Be aware of political bias that could be part of any economic commentary.

As always, we recommend investors not allow short-term events to dictate their long-term view. Please feel free to contact a JMA advisor if you are concerned about how your plan may be impacted by recession potential, volatility or changing interest rates.

Any opinions are those of Brian Cochran and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.