Our Thoughts on Market Volatility

Share This Insight

Stock markets experienced a swift correction over the last week. News of the spreading Coronavirus and the potential for economic disruption triggered a flight to safe investments as everyone does their best to assess the potential risks. The future is always uncertain, and we do not see any value in trying to predict the outcome. We prefer to use investing principles and history as a guide for making wise decisions.

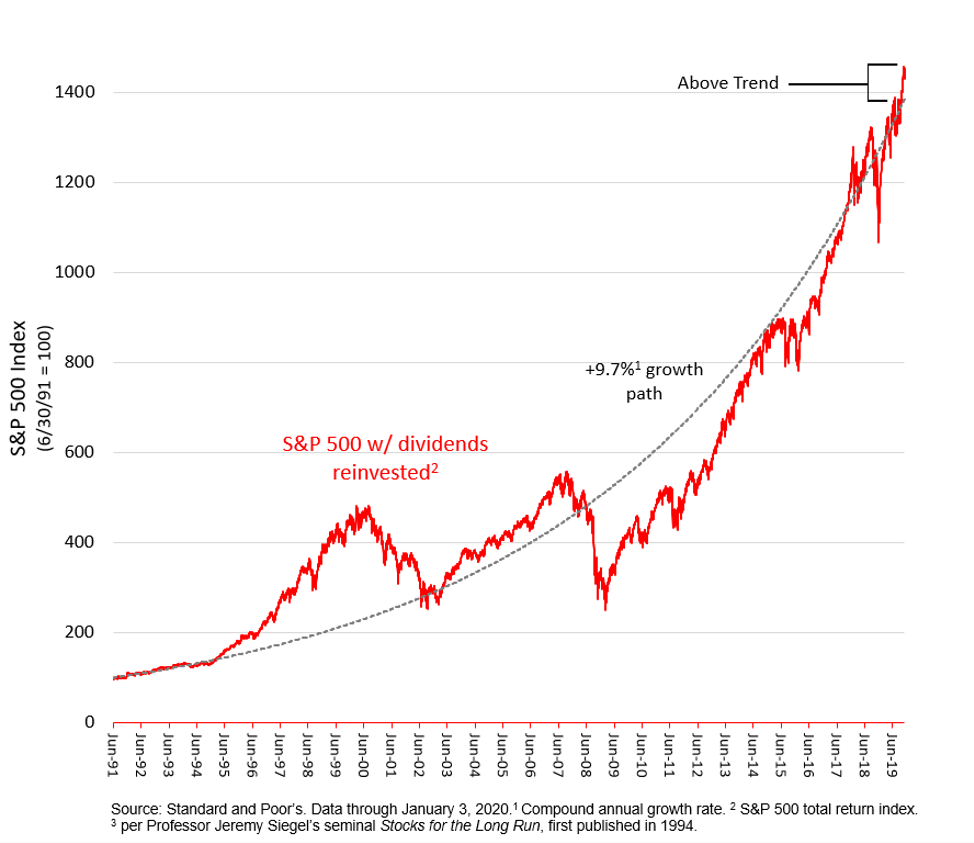

- Stocks were ahead of trend by approximately 10% when Coronavirus news hit. The above-average recent returns may have contributed to the rapid drop in prices. The S&P 500 is back on trend as of February 27th.

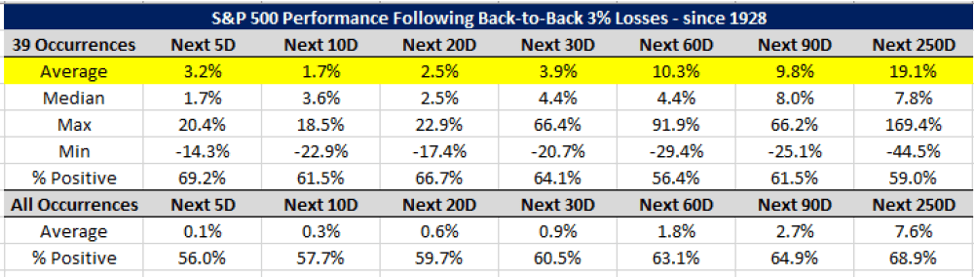

- The decline looks much worse in points than percentages. The Dow Jones Industrial Average dropped by approximately 1,000 points (3%) on February 24th and 25th. We’ve never experienced such a large point drop on back to back days. However, we have experienced two consecutive 3% down days in the S&P 500 39 times since 1928.

- Investing after two consecutive 3% down days has historically resulted in above-average returns (lower prices can result in higher future returns) (Source- FactSet, Raymond James Equity Portfolio and Technical Strategy) With history as our guide, we continue to recommend sticking to the long-term plan. We are encouraged that markets are back on their long-term trend. Investors with the right investment horizon and risk tolerance might consider this a buying opportunity. As always, our advisors are standing by to answer your questions.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Brian Cochran and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Inclusion of these indexes is for illustrative purposes only. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.