Volatile Election, Volatile Market?

Share This Insight

Without a doubt, the most common mistake I’ve seen clients make over the last decade is letting their politics drive their investment decisions. I cannot think of another investment mistake that comes close. As we enter another volatile and heated election season, our clients are again expressing fear about the potential impact the election might have on the market. Our client conversations include two common themes:

- The client asks what I think will happen with the market in November.

- The client expresses concern that markets will plummet if his or her side does not win.

I understand the desire to know what may happen next and the anxiety that comes with change and uncertainty. However, the timeless and transcendent principles of investing apply just as much to election years as any other time:

- The future is always uncertain.

- Market timing is impossible (trying it can be harmful to returns).

- Diversification can help manage short-term volatility.

- Long-term perspective can help avoid costly mistakes today.

These truths do not stop short-term investors from making bets on election outcomes or talking heads from offering their usual bold predictions. For example, energy stocks and financials experienced a significant bump after the 2016 election in anticipation of changing regulations and a more business-friendly administration. Nearly four years later, both sectors are lagging the S&P 500.

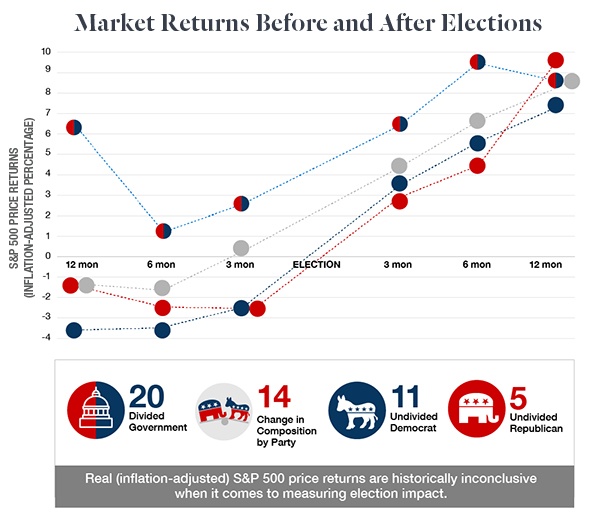

A study of market history proves just how little election outcomes matter to markets. I recently received a wonderfully constructed illustration of elections and how they have impacted the markets.

The following chart clearly expresses the apolitical nature of markets.

Note how S&P 500 returns are generally negative in the year leading up to elections. Twelve months after an election, the returns fall in line with the long-term stock market average regardless of the election outcome. History tells us that elections do not matter to the long-term investor.

This truth is what drives our recommendation to look past the election. You should have a political opinion. You should vote. But you should not let politics influence your investment decisions.

Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Diversification and asset allocation do not ensure a profit or protect against a loss.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.