Expectations vs. Outcomes

Share This Insight

Many investors will tell you that you must time markets, and be in the right place at the right time in order to see progress in your investments. This just isn’t true. This misconception leads to destructive investor behaviors, and may detract from the long-term returns you need for reaching your long-term goals.

Recent changes to inflation, interest rates, and gold can help us learn the folly of market timing. Many investors are concerned about rising inflation and expect costs to continue to rise significantly over the next several months, or even years. With this perspective in mind, some of our clients have inquired about purchasing a traditional inflation hedge, gold, and to avoid a conventional inflation underperformer, bonds. On the surface, this seems logical.

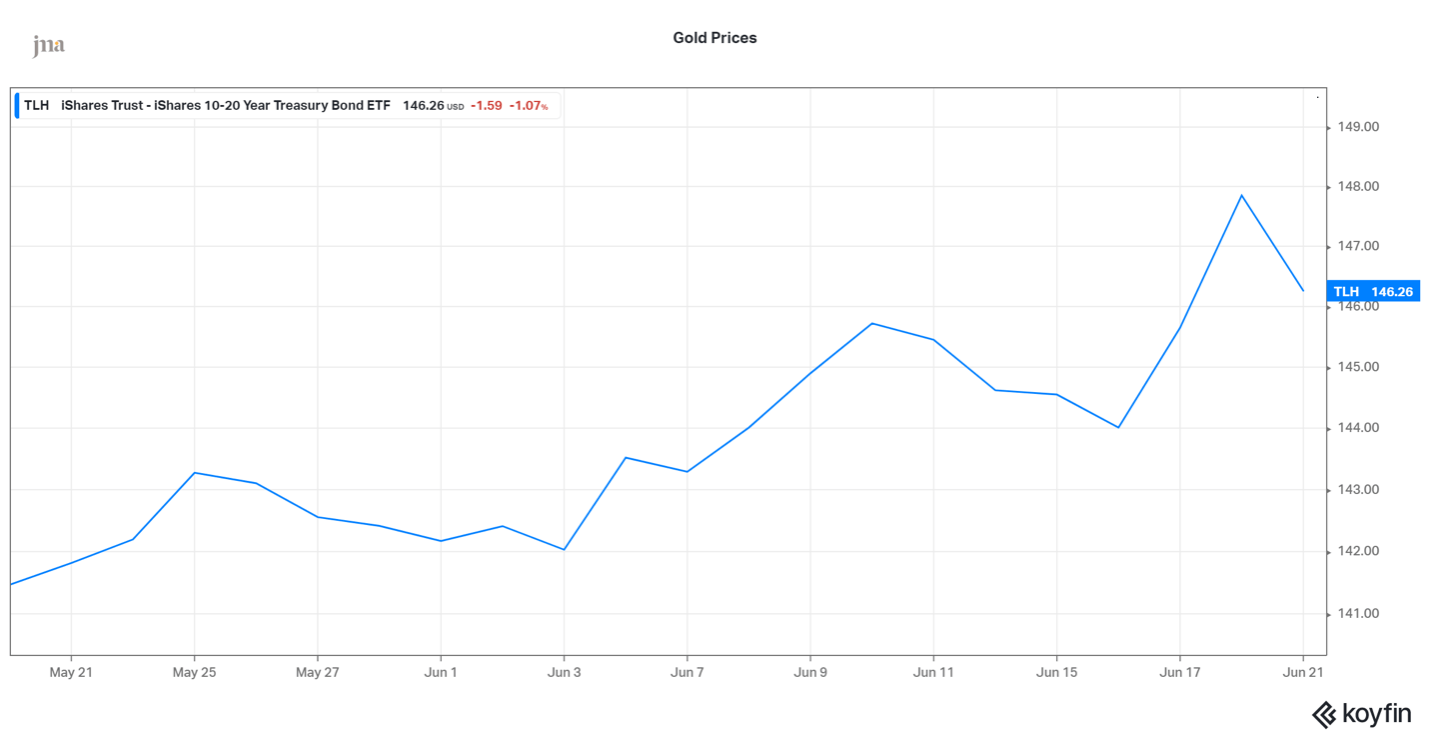

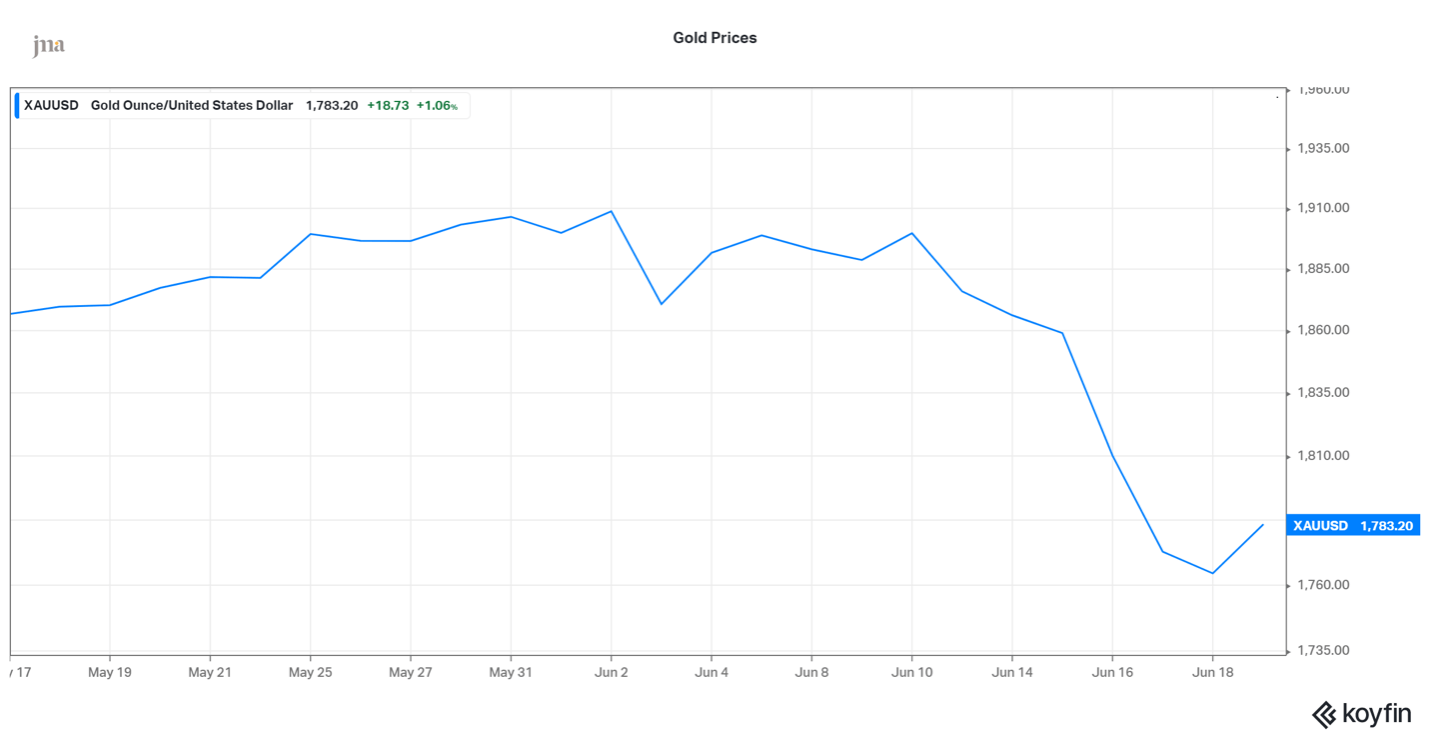

Current economic data shows inflation is running higher than expected, including some data points that illustrate the highest price increases in over 30 years. You would think the investor who predicted high inflation should be pleased with his trades. However, in the last month (as high inflation data was released) gold prices declined while bond prices rose.

Investing can be simple. We make it difficult by constantly try to out-guess the market to gain an edge, make a little extra dough, or avoid a potential downturn. The average investor is wise to set an allocation, abide by rules for regular rebalancing, and avoid the temptation to time the markets. A good, experienced advisor can help guide you through each of these steps (as well as many other investing decisions), and be a wise and emotionally uninvested resource for helping you make sound financial decisions.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.