Rate Hikes Produce Savings Opportunities

Why the Federal Reserve is raising interest rates, and three ways you can grow your wealth in this new economy.

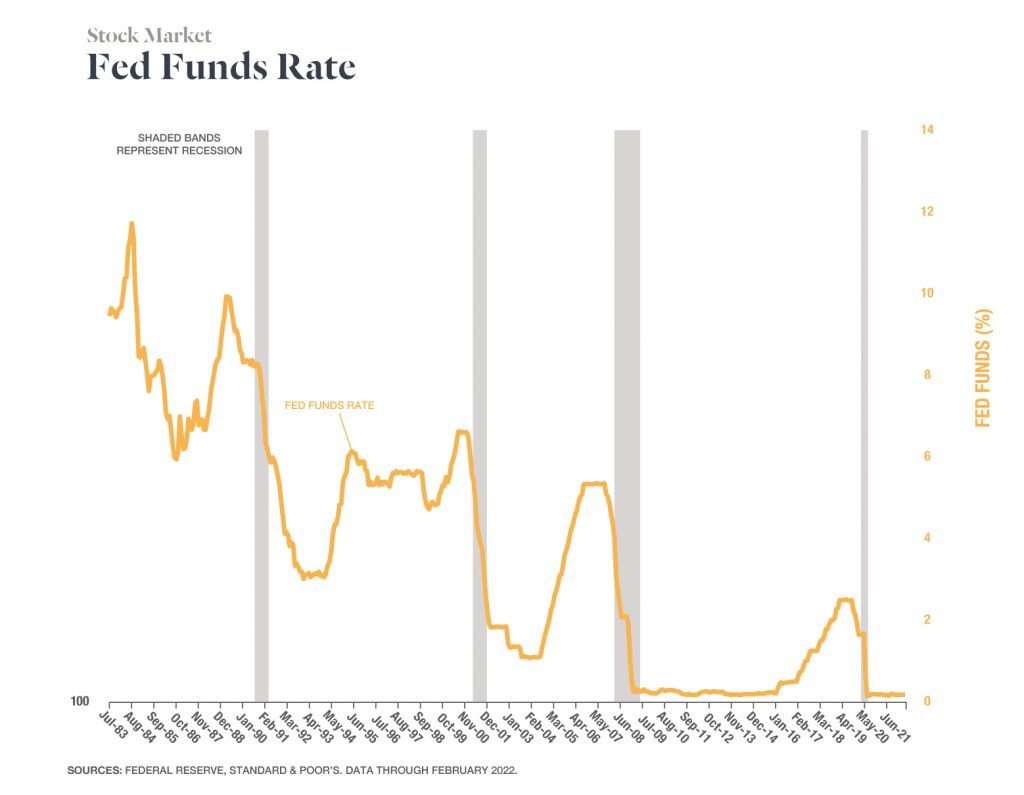

As expected, the Federal Reserve has announced that they will be increasing the federal funds rate by 50 basis points, or half a percent. This rate increase marks the single largest one-time interest increase in several years, and it comes on the heels of another large increase earlier this year. We’re likely to see more adjustments in upcoming months as the Fed continues to grapple with inflation and roll back some of the more generous COVID-era financial policies.

While all of this is expected, it may still come as a shock to the financial system in some ways. Higher interest rates mean worse terms for lending, but they can also create opportunities to grow your savings – if you store your money properly. Below are our top three recommendations for where you can put your hard-earned assets to get the full benefit of these changes.

Put Your Emergency Fund in an Online Savings Account

If you’re not already taking advantage of online savings accounts for your emergency fund or other short-term savings goals, you’re missing out. These virtual banks have the same FDIC insurance protection as the brick-and-mortar banks, but they tend to offer significantly higher yield thanks to their reduced overhead costs.

In the last financial cycle before the pandemicshake-up, we saw online savings accounts offering 2.2-2.4% returns on accounts that might yield a 0.1% interest at a large local or national bank. To put that in practical terms, if you put $100,000 in an online savings account with a 2.4% interest rate, you’d earn $2,300 in interest accrual that you wouldn’t see if you’d gone with a more traditional in-person bank branch.

These accounts are best for money you need to keep relatively liquid or will need to access within a few years. Emergency savings and vacation funds are excellent options for this type of savings. If you’re looking for a more long-term investment with even greater potential rewards, there are better options available.

Use Certificates of Deposit (CDs) for Short-Term Investments

CDs have traditionally been one of the safest and highest-yield options for savings. For the last few years, their interest rates have been lower than many savings accounts, making them a less-appealing option, but that trend looks like it will change in the near future. We’re anticipating higher interest rates on CDs than we’ve seen for several years.

What makes a certificate of deposit better than a savings account? The biggest advantage is the locked-in interest rate, which ensures predictable and guaranteed growth over the period of a few years. The longer the term, the better the rates. If you’re saving for a big purchase, like a home down payment or college fund, setting the money aside into a CD for 3-5 years can yield a significant and guaranteed return without any risk. Like other bank accounts, CDs are FDIC insured up to $250,000 (double that for a joint account with two people), and they provide returns without any market risk.

CDs do have some drawbacks, though. The downside to locking in your rates is that the money loses its liquidity for the duration of the savings term. Cashing out a CD early is tricky and results in harsh financial penalties. For that reason, it’s a good idea not to keep all of your eggs in one basket: set aside some personal wealth in a CD for safekeeping, but keep a bit aside in a high-interest savings account as well in case of emergency.

Consider Money Market Mutual Funds for Your Retirement Savings

Money market mutual funds (not to be confused with money market accounts, or MMAs) are investments sponsored by an investment fund. They are not savings accounts and don’t come with FDIC insurance on the principal, so they do carry some risk. However, as investments go, they are some of the safest and are poised to become more attractive as interest rates continue to climb.

Like all mutual funds, money market funds operate by pooling money from multiple investors, who each receive shares comparable to their initial investment. That pooled money (the mutual fund) is then invested. In the case of money market funds, the investments are made in cash and cash equivalent securities, otherwise known as cash instruments.

With interest expected to exceed 1% and continue rising, money market mutual funds are poised to grow faster than most savings accounts while posing relatively little risk compared to other types of speculative investments. They’re a favorite vehicle for retirement savings because of this. If you currently have money tucked away in an investment or brokerage account, applying those funds to a money market mutual fund investment could earn you some notable growth.

The Bottom Line: You Can Benefit From Higher Interest Rates

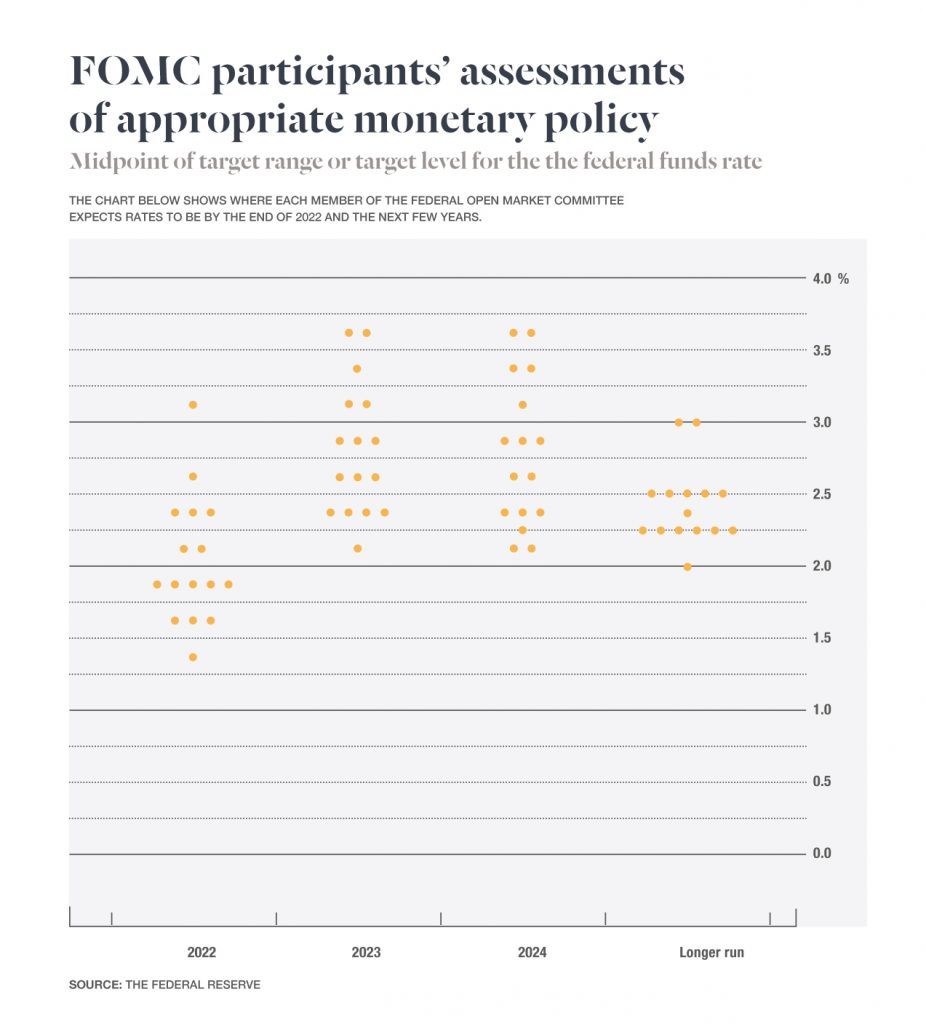

These rate changes fall within predictable patterns, and the Fed has been transparent with its intentions (see graph below). Based on previous rate increases, it’s likely we’ll see interest continue to rise before stabilizing or falling off again

What investments are best for you will ultimately depend on your financial goals, and specific strategies are best discussed with your financial planner. But it’s important to stay abreast of what’s happening and not sleep on these opportunities. The Fed introduces these interest rate increases as an incentive to save, and spending a few minutes setting up one of these accounts can result in significant growth of your personal wealth.