Volatility Doesn’t Always Matter

Share This Insight

Invest according to your savings goals and timeline, not the whims of the market.

It’s natural to feel nervous about the future of your finances when the market is going through a period of volatility. Interest rate changes, stock price fluctuations, inflation, and other economic factors can all lead to feelings of uncertainty.

What’s important to remember, though, is that the movement of the market does not always affect you. Over time, many fluctuations will stabilize. If you’re making smart choices and diversifying your investments, market challenges do not have to pose a significant threat to your finances.

How you should respond to market volatility ultimately depends on your risk tolerance and timeline. Let’s look at some specific factors to consider and break down some financial planning strategies that make sense in a few different situations.

What Are Your Financial Goals?

It’s impossible to make any real progress without a goal in mind. This is as true of your finances as anything else in life. You need a clear picture of why you are saving this money and what purpose the funds will be applied toward. Are you setting aside an emergency fund? Saving for retirement? Setting up college funds for a child’s education? Preparing a foundation to pass along generational wealth?

Every financial goal should have a dollar amount and a timeline attached to it. How much money do you need to have saved? When will you need access to that money? Once you have those two pieces of information, you are in a good position to make investment decisions that will leave you in the right place when volatility comes.

How Soon Will You Need Your Money?

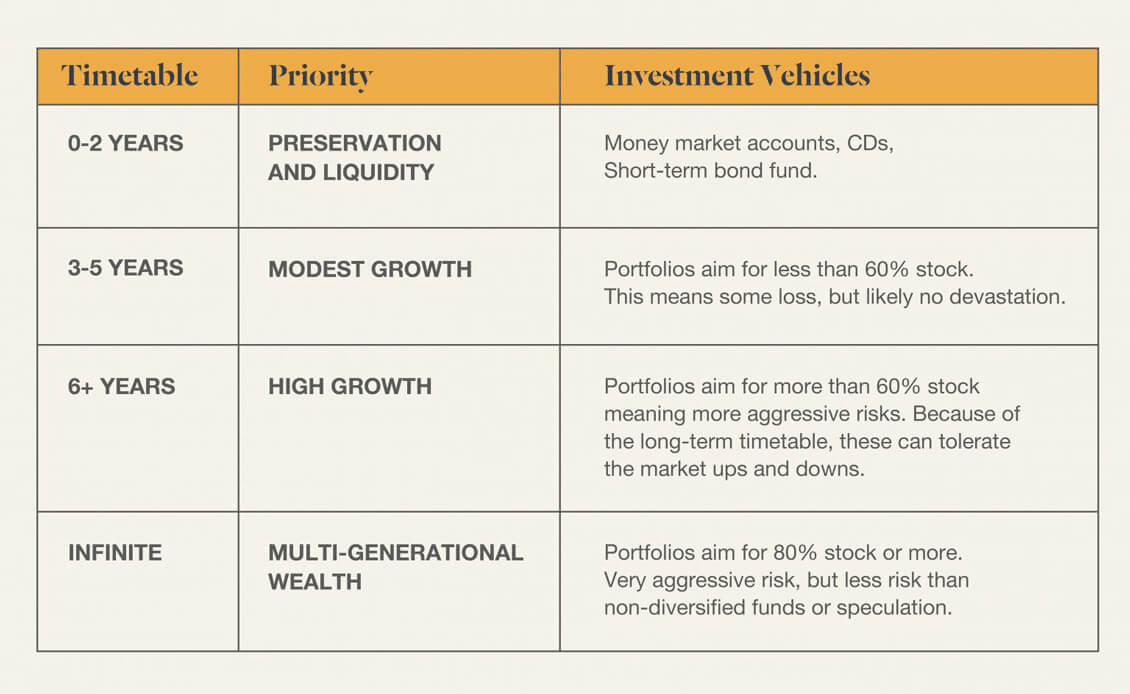

The timeline of your financial goals will guide the nature of your investments.

0-2 Years: If you’re setting up an emergency fund or saving toward a smaller purchase you plan to make within the next year or two, your priority is preservation and liquidity. This is not a time to take any risks with your investment. Opt for a high-interest savings account, a certificate of deposit (CD), or a low-risk investment like a money market fund or short-term bond.

3-5 Years: Goals with this timeline might include saving for a down payment on a home or a child’s education fund. The goal is moderate growth, which involves slightly more risk. A diversified portfolio with less than 60% stock and the rest in low-risk options will usually provide the best balance of growth and security.

6+ Years: Longer-term savings such as retirement funds can afford to be a bit more aggressive. Aiming for high growth over a longer period means being able to weather the storm of short-term market volatility. A balanced portfolio with 60% or more in stock is poised to grow best in the long term without risking too much of your principal.

Long Term: An “infinity” portfolio for multigenerational wealth accumulation can afford to be much more aggressive. This is money that will go beyond you and your children and help to serve future generations of your family or contribute toward a charitable legacy. Because liquidity is not an issue with this type of fund, you can afford to be more aggressive. Up to 80% stock is appropriate here. Research suggests that an 80% stock portfolio has nearly the same return as placing 100% in stocks but experiences significantly less risk and volatility.

Regardless of the timeline, a diversified portfolio is an essential part of financial planning. Even the most aggressive investments should follow the principles of diversification by spreading investment dollars across multiple stocks and avoiding speculative investments. Your financial planner can help you create a portfolio that best balances risk and growth to serve your long-term goals.

Different Goals, Different Strategies

When approaching money management, it’s best to think in terms of individual buckets or silos that hold funds for different purposes. You likely have a variety of financial goals, and each of those goals has its own timeline. Maybe you’re saving for a big vacation next year or a vacation home within five years. Perhaps you’re planning a large gift of appreciated securities to a charity in the future and need to grow it first. Segmenting your money allows you to be more intentional about your investments and plan more wisely.

Keep your funds separated and maintain multiple risk portfolios to maximize returns on specific investments while minimizing risk to your overall wealth and future goals.

Eliminate Anxiety with a Long-Term Perspective

Market volatility in the day-to-day has little effect on most long-term investments. A properly diversified portfolio will weather most storms and grow over time regardless of more minor ups and downs. When you keep a sense of perspective about your goals, you can be confident about the financial planning decisions you make today regardless of market challenges.

The strategies are hypothetical examples for illustration purposes only and do not represent an actual recommendation. Please consult a Financial Advisor to discuss your situation.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.