The Wealth Effect

Share This Insight

When people feel rich, they spend more. But the effect doesn’t last.

Remember when the government mailed us checks? Or perhaps you recall the day when the direct deposit stimulus payment hit your bank account? COVID was raging, businesses were forced to close their doors, and fear was everywhere. Yet, for many Americans, it was a simpler time, at least financially.

An unforeseen result of COVID and the stimulus that accompanied it was the rapid appreciation of assets of nearly every kind. This includes stocks, bonds, real estate, cryptocurrencies, used cars; you name it, it likely went up in value. All that stimulus and asset appreciation caused something known as the Wealth Effect to increase substantially.

Wealth Effect Theory is the idea that when asset values rise, people begin to feel wealthier and tend to spend more. This is generally a good thing for the economy.

Thanks to the Wealth Effect, Americans felt rich. They found themselves flush with cash in a shutdown economy with limited places where they could spend their newfound wealth. Many Americans paid off debt, purchased goods online, and renovated their homes. Life was pretty good, except for that whole pandemic thing.

Fast forward to Summer 2022.

Inflation is at a 40-year high, the stock market has fallen into “bear market territory,” and recession talk looms. COVID may not be in the headlines as frequently, but for many Americans, their financial lives have gotten much more complicated. Why?

Let’s take a closer look at what’s happening to the American consumer.

Inflation

Cost of living in this country has spiked at rates that we have not seen in forty years. We have spent the last twelve years with a steady, nearly unnoticeable inflation rate of around 1.5% per year.

The last twelve months have seen that number spike to around 8.5%. Inflation is high, and that makes life more expensive for all of us.

Consumption

As inflation drives prices up for everyday goods and services, consumers naturally must cut their spending. Personal consumption numbers have dropped sharply as Americans no longer have the spending power they once had.

As our friend David Summers says, “The cure for high prices is high prices.” High costs for goods and services are forcing Americans to consume less. On the bright side, this decrease in demand could help slow inflation. Only time will tell. In the meantime, we will all need to be more intentional about our spending.

Savings

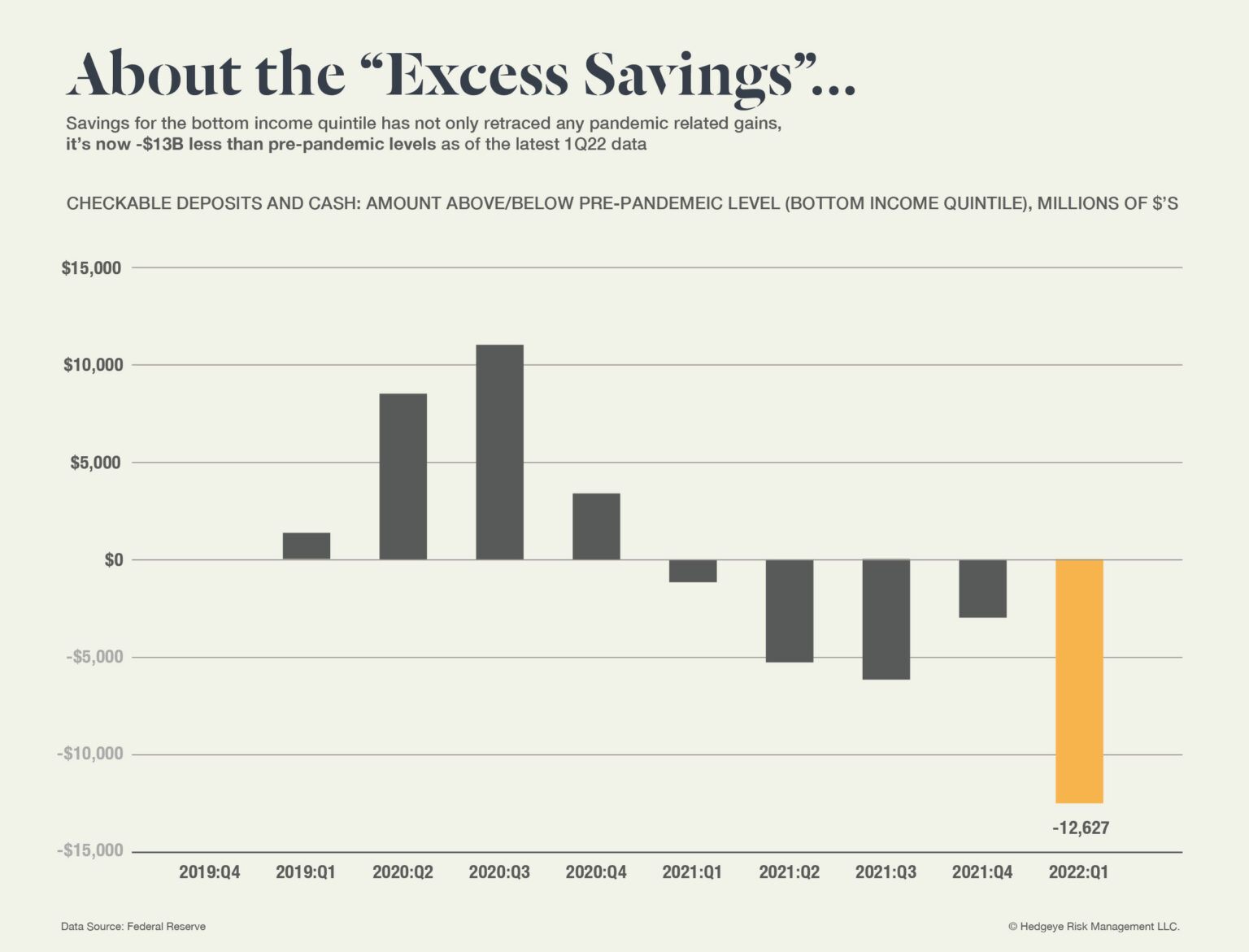

Prices are increasing, consumption is waning, and savings accounts are now well below pre-pandemic levels. Six months into COVID, in the second half of 2020, personal savings balances were at all-time highs, particularly for the lower-income families in our country.

The bottom 20% of income earners had their highest savings account values ever. This subset of the population experienced wealth like never before, as their savings accounts collectively increased by over $10 billion from the beginning of 2020 to the third quarter of 2020.

Today, that same group of Americans has $13 billion less than they did before COVID. That is a decrease in wealth of over $23 billion in just 18 months for the lowest earners in our economy.

Credit Usage

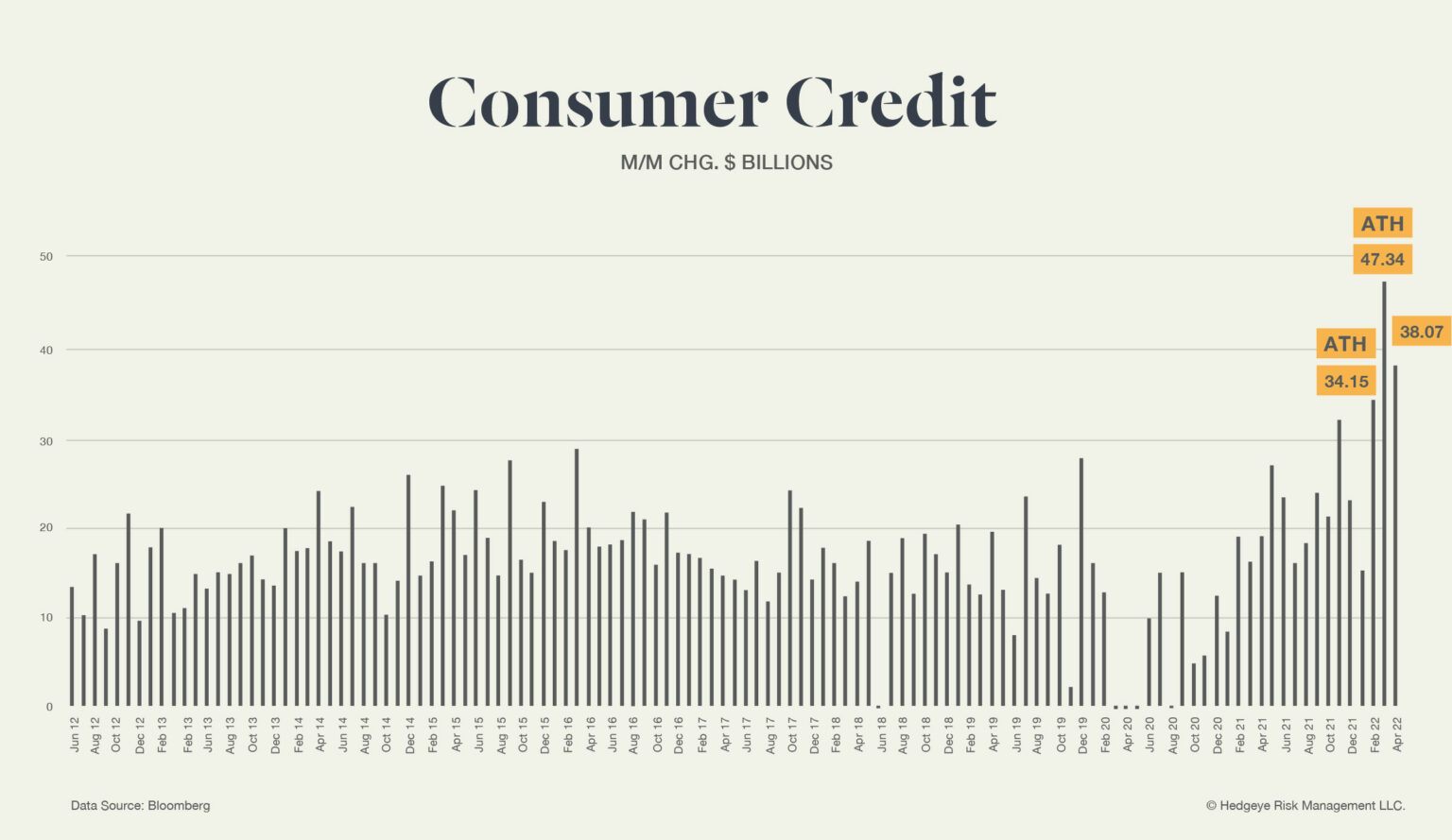

Prices are up, spending is down, savings are down; the next step in the progression is an increase in credit usage. Usage of consumer credit is increasing at the fastest rate in history. We went from all-time low household consumer debt and are now accelerating at the highest rate of all time.

Credit Cost

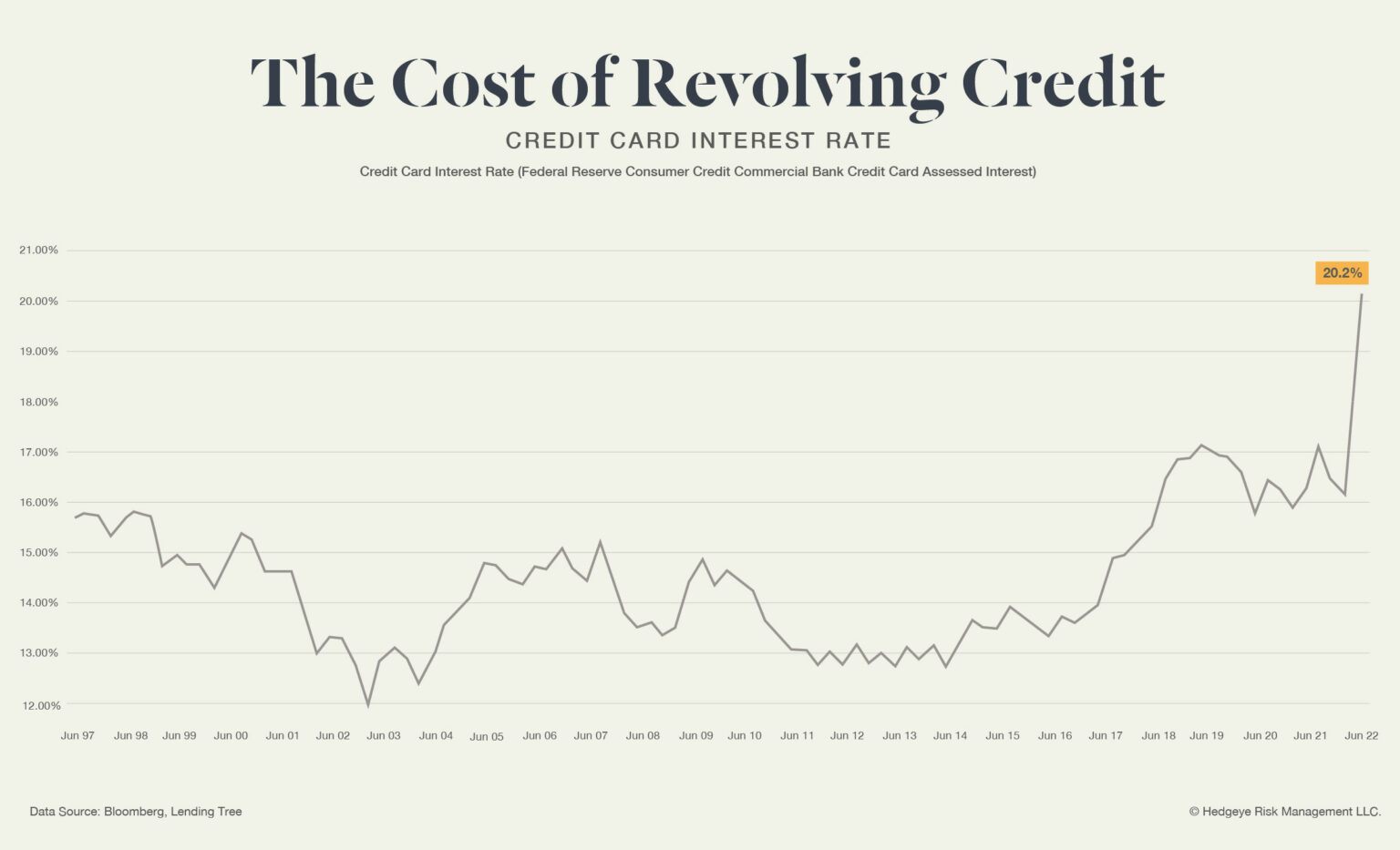

Simultaneously, as credit usage soars, we are watching the cost of credit increase to its highest levels in decades. Unfortunately, the section of the population most likely to use high-interest credit are those in the lower income brackets with little or no cash savings.

Consumer Sentiment

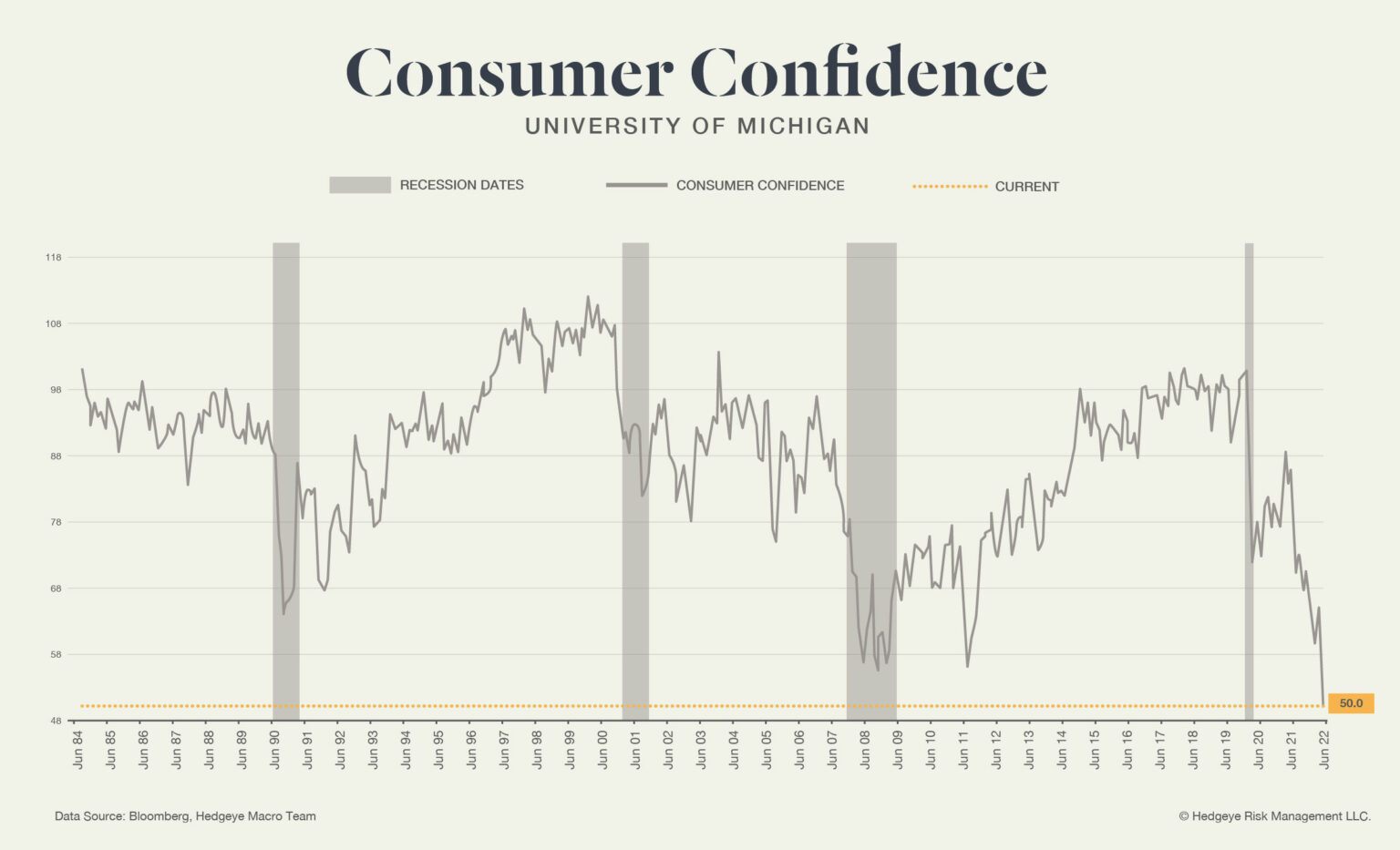

Not surprisingly, all of this data has caused consumer sentiment to decline to all-time lows. This means The Wealth Effect that the economy thrived on in 2020 and 2021 has stalled and begun to decline as the reality of the current economic situation sets in.

So, What Do I Do Now to Protect My Finances?

If you find yourself feeling like your budget is a little tight, or maybe you have had to dip into your emergency fund, you’re not alone. But there’s no reason to panic. COVID created some extreme conditions, but the fundamentals of financial stewardship haven’t changed.

No matter your stage of life or financial standing, this is a great opportunity for two immediate actions for anyone that is feeling the pinch of our current economy:

- Audit your expenses. Do you have leaks in your monthly spending? Are there areas that you could cut back, choose a cheaper alternative, or eliminate altogether?

- Create a spending plan. Budgeting is generally reactive. Planning is proactive. After you get a handle on your expenses from your audit, utilize that information to create a plan for how to spend your income in the coming months. The plan should account for living expenses, debt service, giving, and saving.

Using an expense tracking/planning app like MoneyWise can help simplify your expense audit and automate your monthly spending plan.

We’re in a challenging economic environment, and if you are feeling the pressure, you are in good company. Millions of Americans are right there with you. Taking the proactive steps of auditing and planning your spending will help you navigate this current financial season and set you up for even greater success in the future.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.