Markets are Forward-Looking

Share This Insight

Reacting to market changes is not the way to grow your wealth.

It can be tempting to turn on the news each morning and watch the stock numbers with a sense of anxiety. Seeing your investments performing well might fill you with a feeling of security. Maybe you even want to put more money into those same holdings. If your portfolio performs poorly, your instinct might be to pull out your money before the losses get any worse.

These instincts are very human and understandable, but they’re harmful.

The thing you need to understand about the stock market is that, by the time you see the news, all of the changes and variables affecting stock prices have already been priced into the market. That’s what is meant by saying a market is “forward-looking.”

Stock prices reflect an investor consensus of what’s expected to happen in the near future, not a response to what’s already happened. This is why markets often seem to improve before the news turns positive. In other words, other investors already know the same information that you do, and any changes you make now in response to the market will likely be too slow to have the effect you’re hoping for.

Long-Term Investors Get to Participate Rather than Predict

It’s important to remember that 90% of all investment assets are handled by big institutional investors. These professional investors drive the market behavior in large part through their predictions and expectations. They do this full time, have access to powerful computing and analysis tools, and they sometimes still make wrong guesses and lose spectacularly.

But as an individual investor, you don’t need to play this predictive game. You can participate and ride along with the professional investment managers to enjoy the benefits without taking the same level of risk.

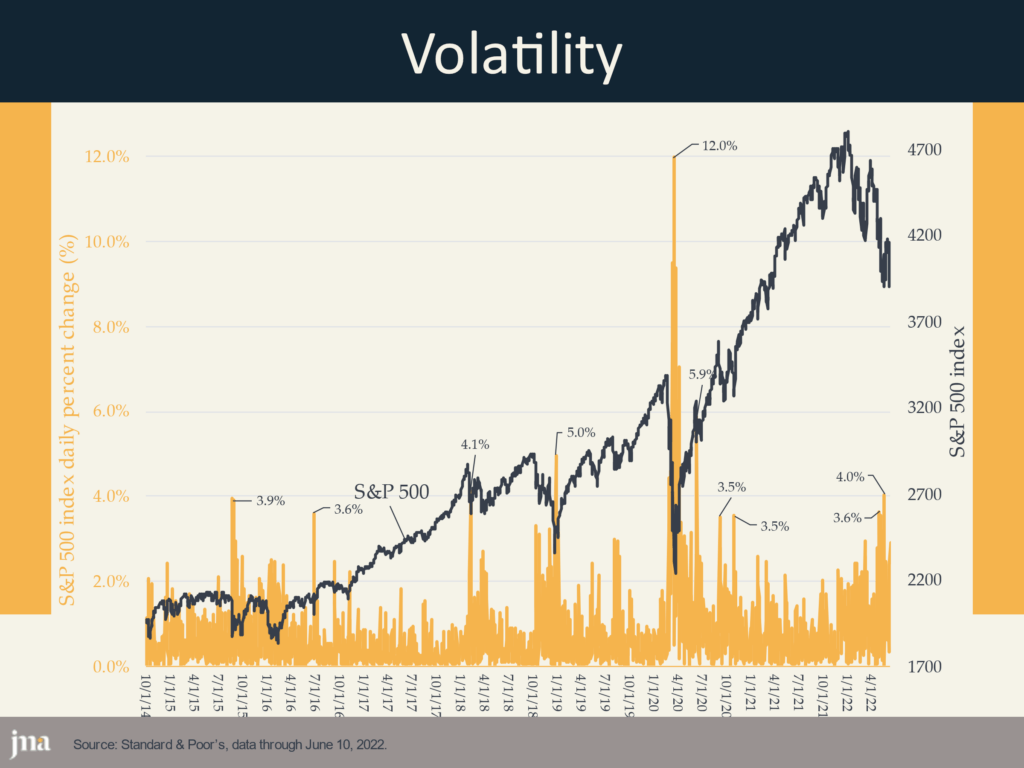

We’ve seen that year-over-year growth for long-term, diversified investments tends to hover very reliably around 10%. In the short term, that number may fluctuate. But in the long term, viewed over decades, the returns for diversified portfolios are very consistent.

If you’re investing in your retirement or a child’s college fund, the short-term behavior of the market doesn’t matter. That long-term growth is what you’re looking for. And as long as you have a balanced portfolio of diversified investments adjusted to a reasonable level of risk, you shouldn’t be overly concerned with day-to-day price fluctuations.

Don’t Miss the Market Recovery

One important investing principle we tell all of our clients: you never want to miss the recovery phase. Some of the best profit growth occurs during market recovery, and you’ll miss it entirely if you pull out your money when times look uncertain. By the time you start seeing signs of improvement and put your money back into investments, you’ve missed the profitable growth.

Remember that adage, “Buy low, sell high?” It’s true. If you sell on a downtrend, the market might already be on an up trend, and you’ll miss it. Investors who wait for the news to get better often end up surprised that prices are already much higher, and the opportunity has passed. People who pull their investments out of fear often struggle with finding the right time to re-enter the market for this reason. If you’re looking at the news for investing strategy, you’ll always lag behind the market because the market is a leading indicator.

We saw this during COVID, when the market dipped dramatically, losing 30% of its value in a few weeks. Investors panicked and pulled their investments. But by the time the economy was in recovery and positive GDP was reported, the market was already 30% off its bottom. People who left their investments in place to weather the storm saw the market rise 60% from its lowest point – before COVID cases fell to a consistent low and before the news reports improved. Anyone waiting for a sign would have missed that growth.

COVID was a dramatic circumstance, representing some truly extreme scenarios. Still, the basic principles behind market behavior during that period were no different than they are the rest of the time.

Worry is Optional

“Can any one of you by worrying add a single hour to your life?” Matthew 6:27

How do you prevent yourself from playing the market timing game and always falling a step behind? Remove yourself from worry and stop trying to outguess the market.

There is some value in staying informed. You shouldn’t keep your head in the sand and ignore the world around you entirely. And it is understandable to be concerned when faced with uncertainty. But worry is not a productive emotion. It can drive you to seek out additional information that confirms your worst fears, and allowing that confirmation bias to cloud your judgment can lead you to make short-sighted financial decisions.

Our advice: if you’re stressed, take a sabbatical. Walk away from the news. Spend some time with your family, or doing work in your community, or volunteer at your church. Your time and energy will be better spent making a difference than worrying over financial markets and other things outside of your control.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.