Recession Reality Check

Share This Insight

If we have a recession in the next year, it will be the first one that everyone saw coming. Everywhere I go, people are talking about “this recession,” “the coming recession” or “Trump’s recession.” It is almost as if a press release was sent out by the economy announcing a recession is scheduled to occur at a predetermined date.

Recessions are not announced. They are not predictable or easily timed events. No matter what the latest “expert” says or writes, the future is always uncertain. We are living and investing in an environment where a single tweet or comment from the Fed can shift the market 5–10%. Calling this market environment unpredictable would be an understatement.

With that in mind, let’s review a few key factors about the current environment and past recessions in order to gain a little perspective.

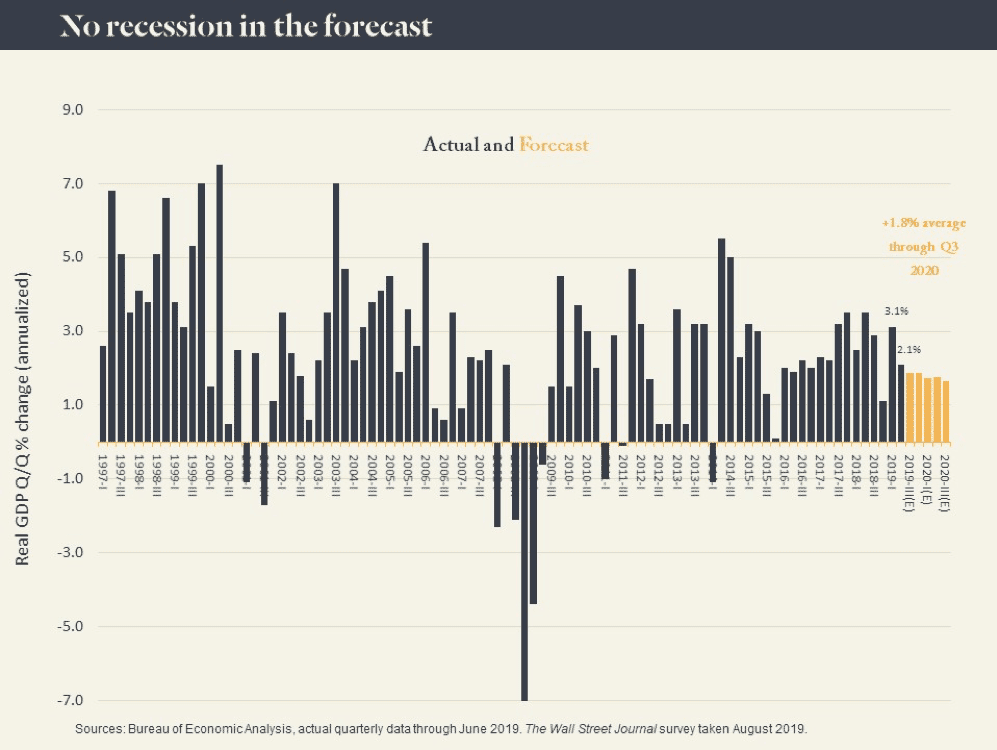

1. Repeat after me: We are not currently in a recession! The broadly accepted definition of a recession is two consecutive quarters of negative GDP. The U.S. economy GREW by 2.2% last quarter and economists expect growth in the 1.5%–2% range for the next year. Economists are horrible at predicting recessions because they cannot tell the future. However, they do a good job of understanding the data we have now.

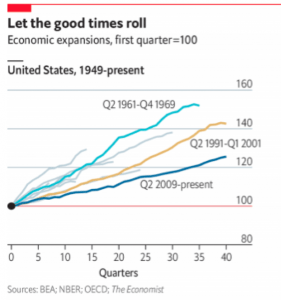

2. Expansions do not die of old age. Much is being made of how long it has been since the last recession. In fact, we recently broke the previous record of 120 months of economic expansion. However, this particular expansion has been consistently sluggish. The Economist provided an enlightening chart showing how little the economy has actually grown since 2009. Neither the current administration nor the previous has much to brag about when it comes to driving robust economic growth.

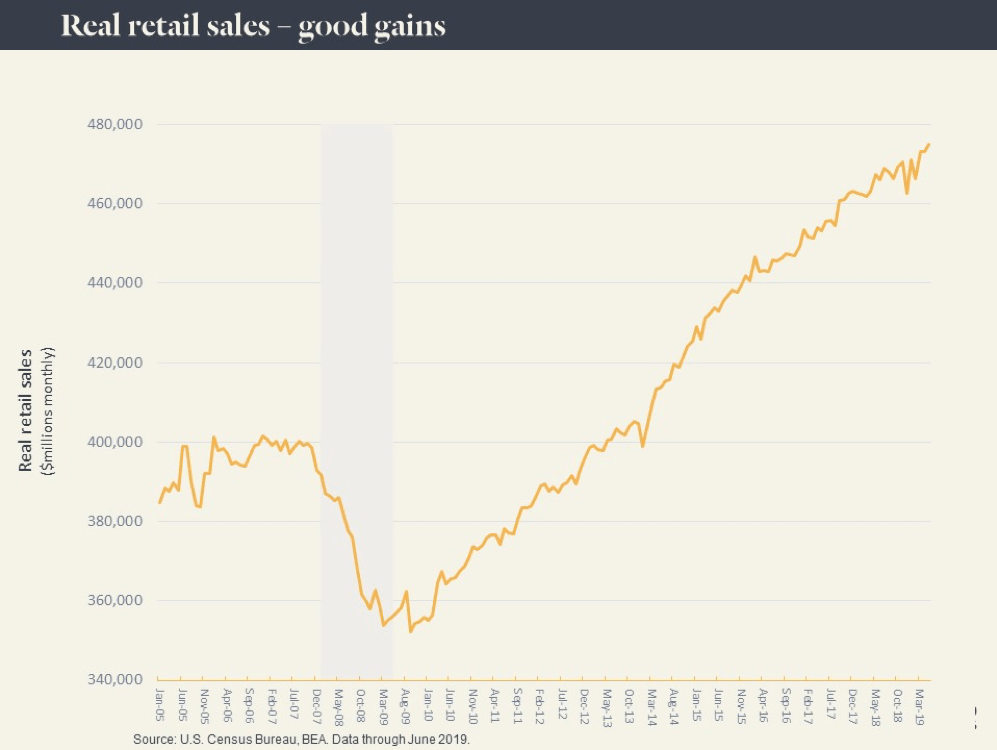

3. Consumer spending makes up 70% of our GDP, and spending is growing at a healthy rate. It’s hard to see a recession when consumers continue to drive the economy forward. Americans are employed, their wages are growing and they feel confident enough to spend. That said, we could (in theory) talk ourselves into a recession if we were all to panic and slow our spending.

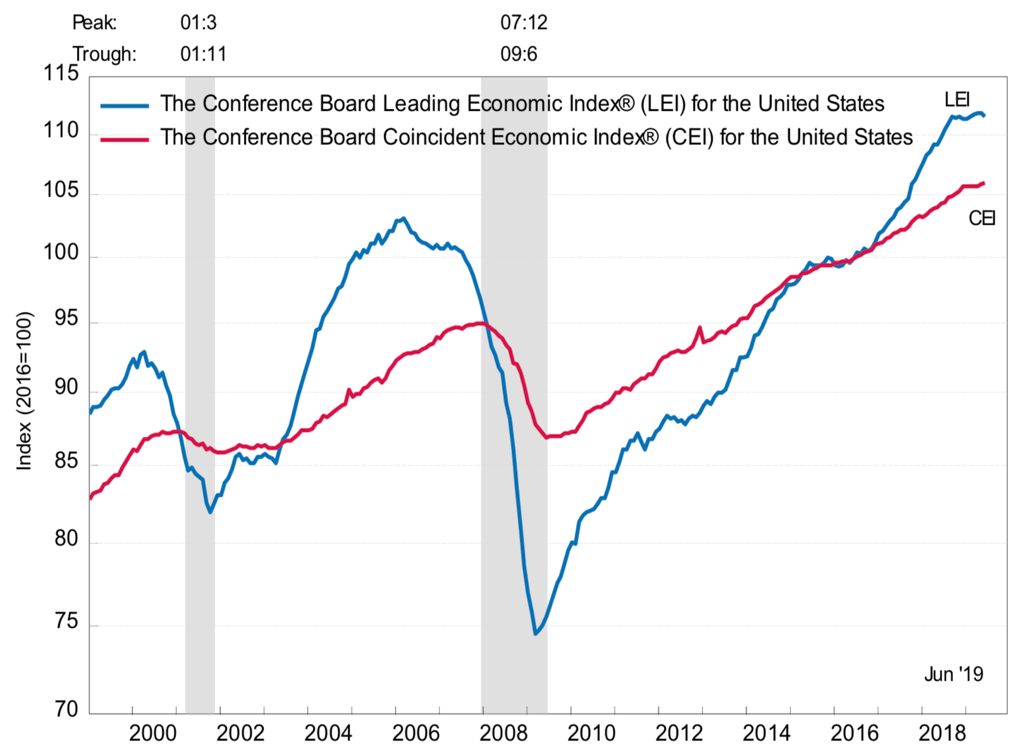

4. The Leading Economic Index (LEI) is flat, but has not turned over. The LEI may be the best indicator we have for projecting the future growth of the economy. You cannot time markets based on the LEI, but I trust its projections more than your plumber or my neighbor who watches way too much CNBC.

5. If we do fall into a recession, it likely won’t look anything like 2008–2009. The last recession was over 18 months of brutal, global economic malaise accompanied by a drop in the S&P 500 of over 50% from peak to trough. It was a traumatic but unusual recession. The typical recession lasts approximately 10 months, and market performance during recessions since the 1950s has varied from +18% to -35%. Trying to predict when the next recession will occur is nearly impossible. Predicting how it will play out is even more challenging.

I am by no means saying we cannot or will not have a recession in the next year. However, I feel that anyone who says a recession is a high probability event is actually predicting a major shift in the direction of the economy. Such shifts are extremely hard to time. Becoming stressed and fearful, or changing your investment strategy based on these predictions, is counterproductive and should be avoided by investors of any age, investment horizon or risk tolerance.

History suggests we will likely experience a recession every 4-10 years for the rest of our lives. Each will be unique and unpredictable. Most will present a buying opportunity for long-term investors. If you do not currently have an investment strategy in place that takes these facts into account, we are here to help.

Views expressed are those of the author and not necessarily those of Raymond James and are subject to change without notice. Information provided is general in nature and is not a complete statement of all information necessary for making an investment decision and is not a recommendation or a solicitation to buy or sell any security. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.