Who Really Pays the Most Taxes?

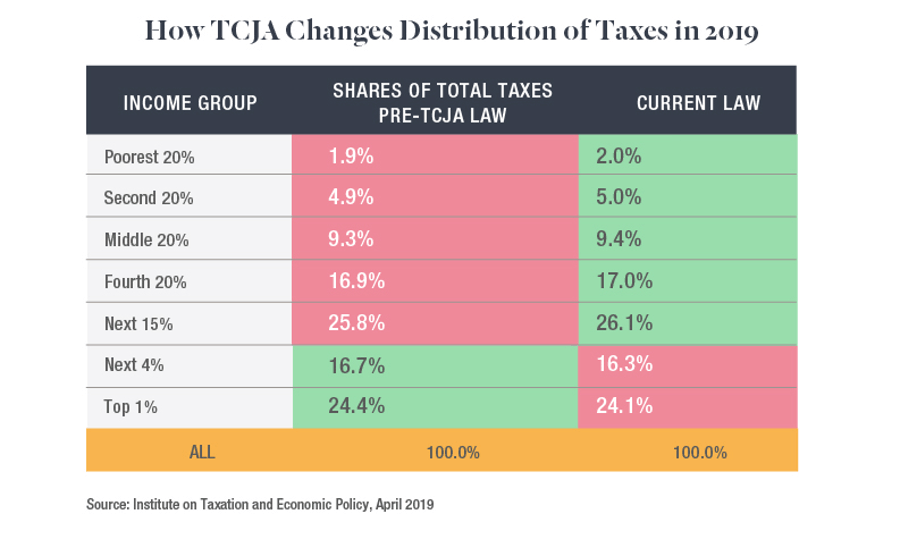

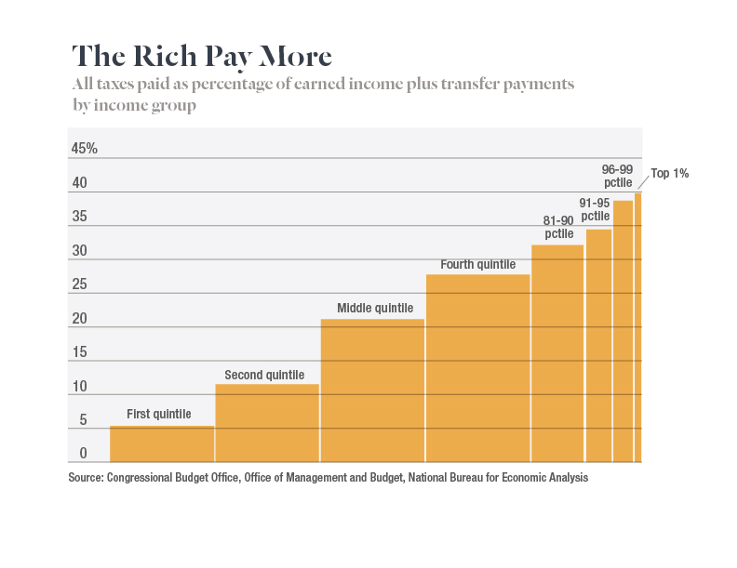

Tax commentary from both politicians and the public leads me to think very few people understand how our tax system actually works, and who is paying the bill to operate our government. The Tax Cuts and Jobs Act (TCJA) compounded the sentiment that the rich pay too little in taxes, and the poor and middle class are left to shoulder the burden. I thought tax season would be the perfect time to look at the numbers and let them speak for themselves.

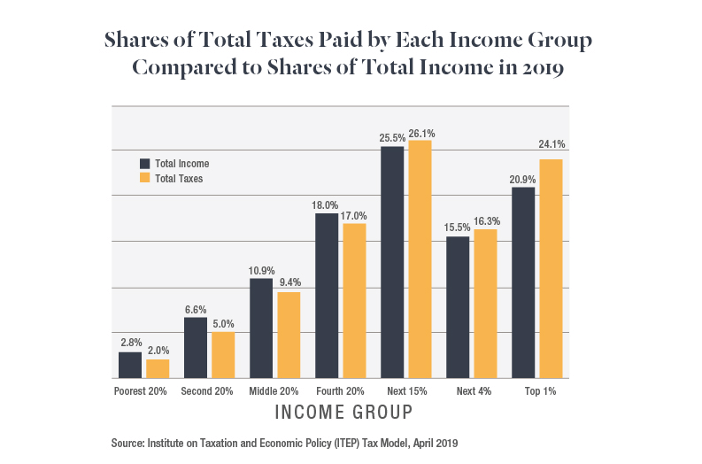

- According to the Institute on Taxation and Economic Policy, the bottom 60% of Americans pay 16% of all taxes, while the top 5% pay 40%.

At the end of the day, all tax-payers contribute to keeping the cogs of our government turning. But a lot fewer are required to pay the lion’s share.

Any opinions are those of Brian Cochran and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.