Time to Stop the Stimulus

Share This Insight

The economy is in recovery, which means we are no longer in need of massive government intervention and relief. When COVID-19 first hit, we saw the Federal, State, and local governments shut down their economies to slow down the virus. Economists and politicians will spend years debating whether the benefits of the shutdowns justified the widespread adverse effects.

After learning the lesson about moving too slow to support the economy during the 2008 financial crisis, the Federal Reserve and Congress went into immediate action to prevent the economic shutdown from turning into a deep and long-lasting recession. The Federal Reserve dropped the short-term interest rates to zero and initiated a bond-buying program to lower long-term rates. After passing two more minor bills totaling $233 billion, Congress passed the CARES act, appropriating $2.2 trillion for workers, businesses, tribes, and state and local governments. Congress followed up with the $483 billion Paycheck Protection Program and Health Care Enhancement Act on April 24, 2020, the $920 billion Consolidated Appropriations Act on December 28 of that same year, and the $1.9 trillion American Rescue Plan in early 2021. The total relief adds up to over $5.7 trillion in stimulus spending approved in less than a year.

Was it too much stimulus? Should we provide more? I suggest it’s time to slow or stop artificially stimulating the economy. Here is why:

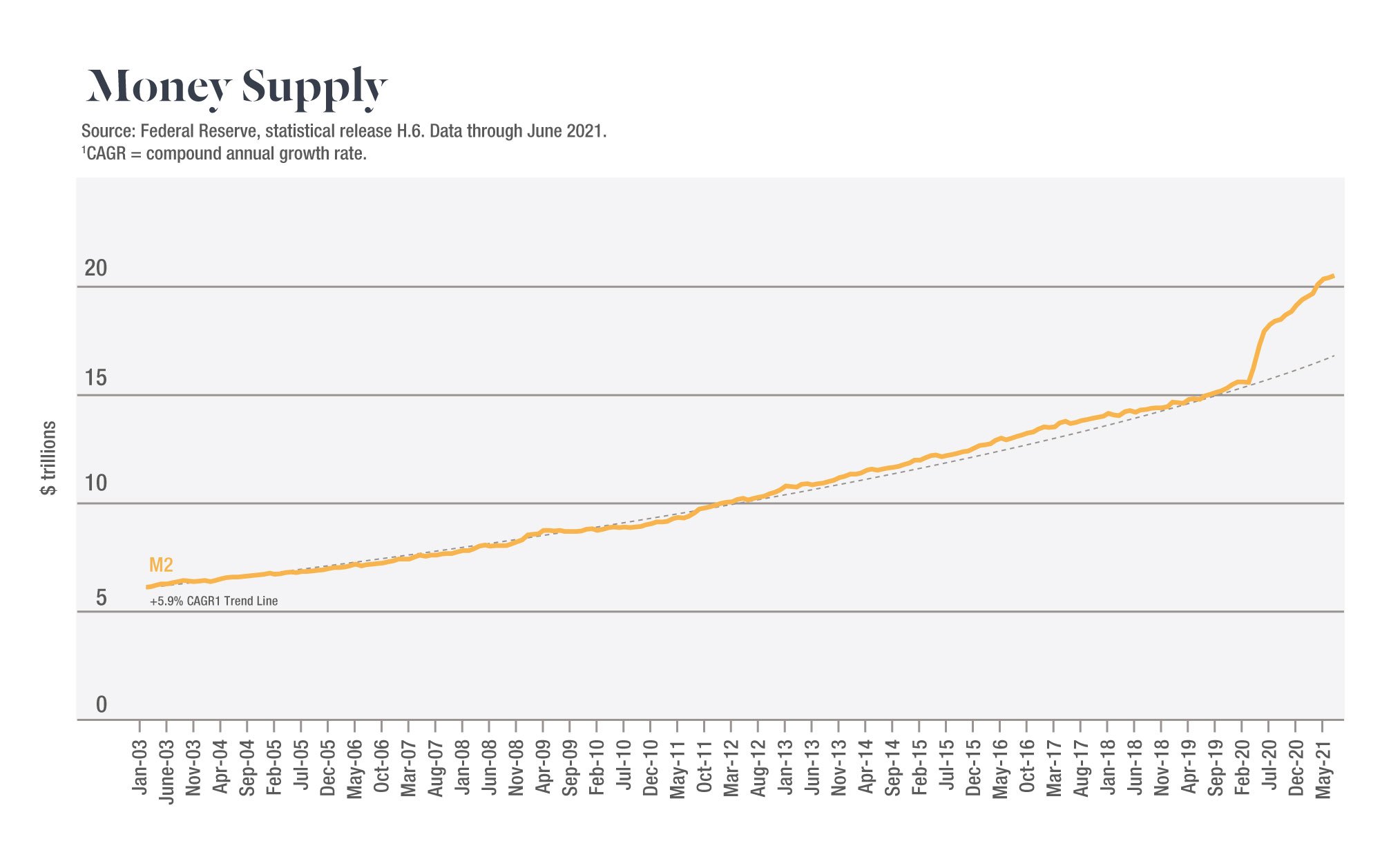

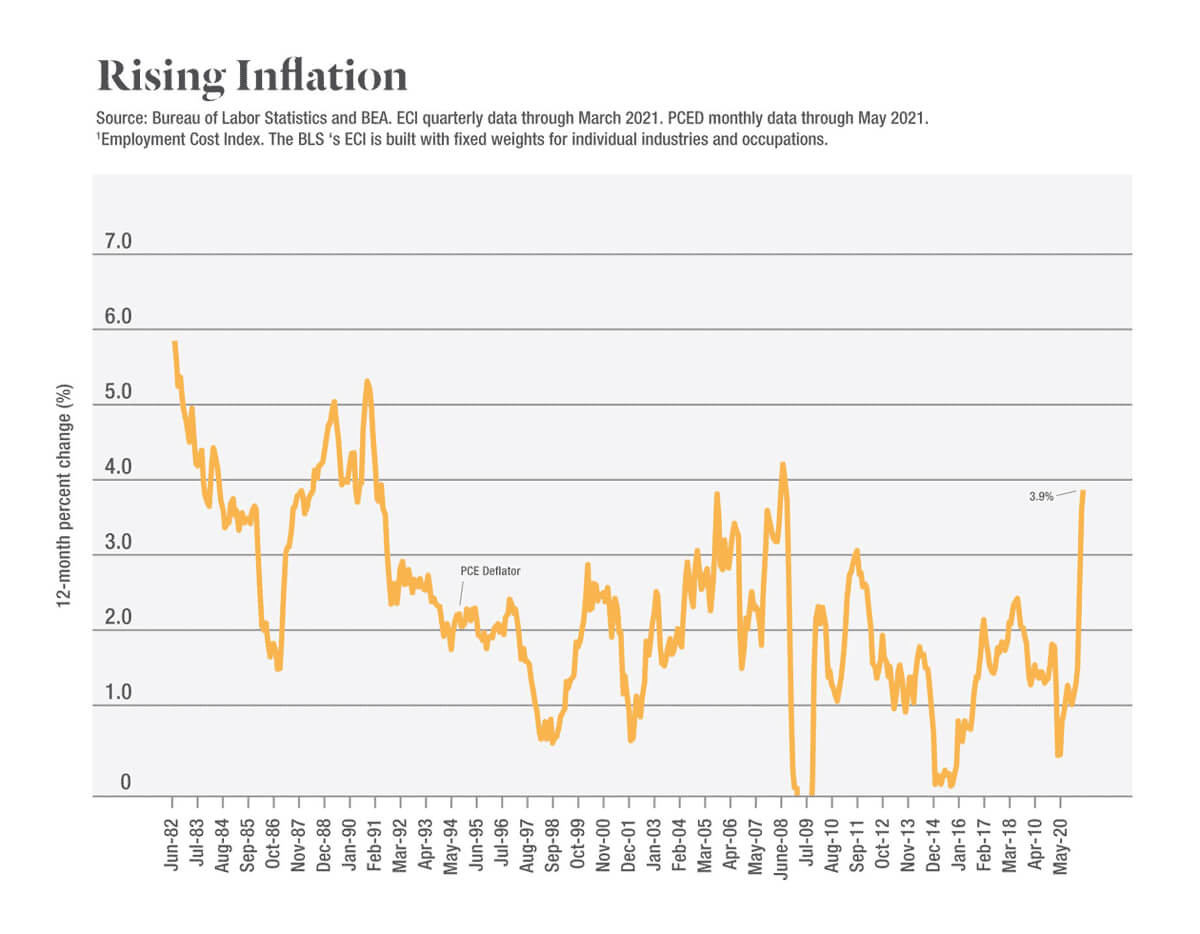

- We have inserted too much money into the economy. The excess demand from the stimulus bills caused rapidly increasing inflation.

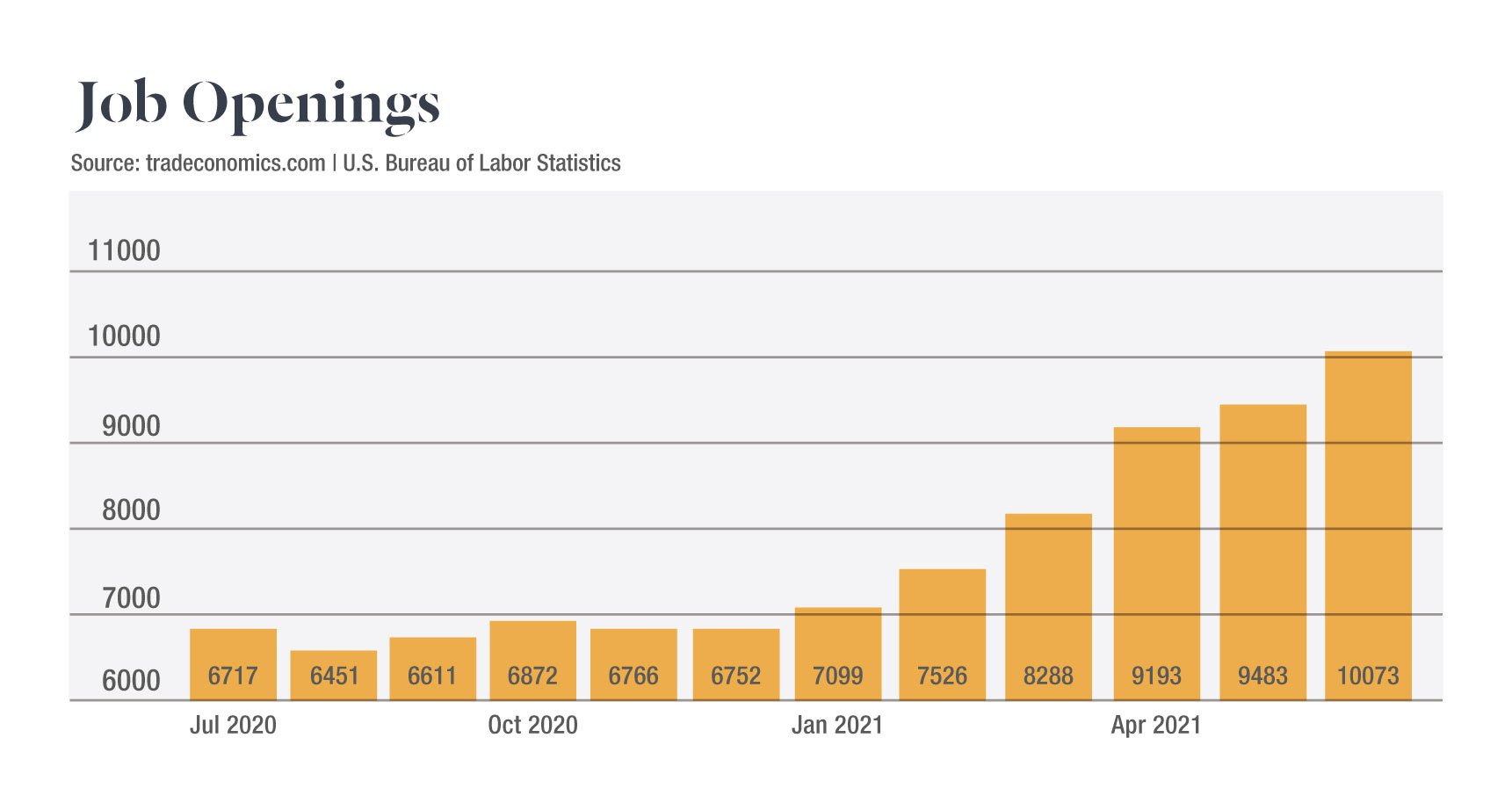

- Job openings are at record highs. The US Bureau of Labor Statistics data shows over 10 million job openings, an increase of 3 million since January. The economy is begging for more workers.

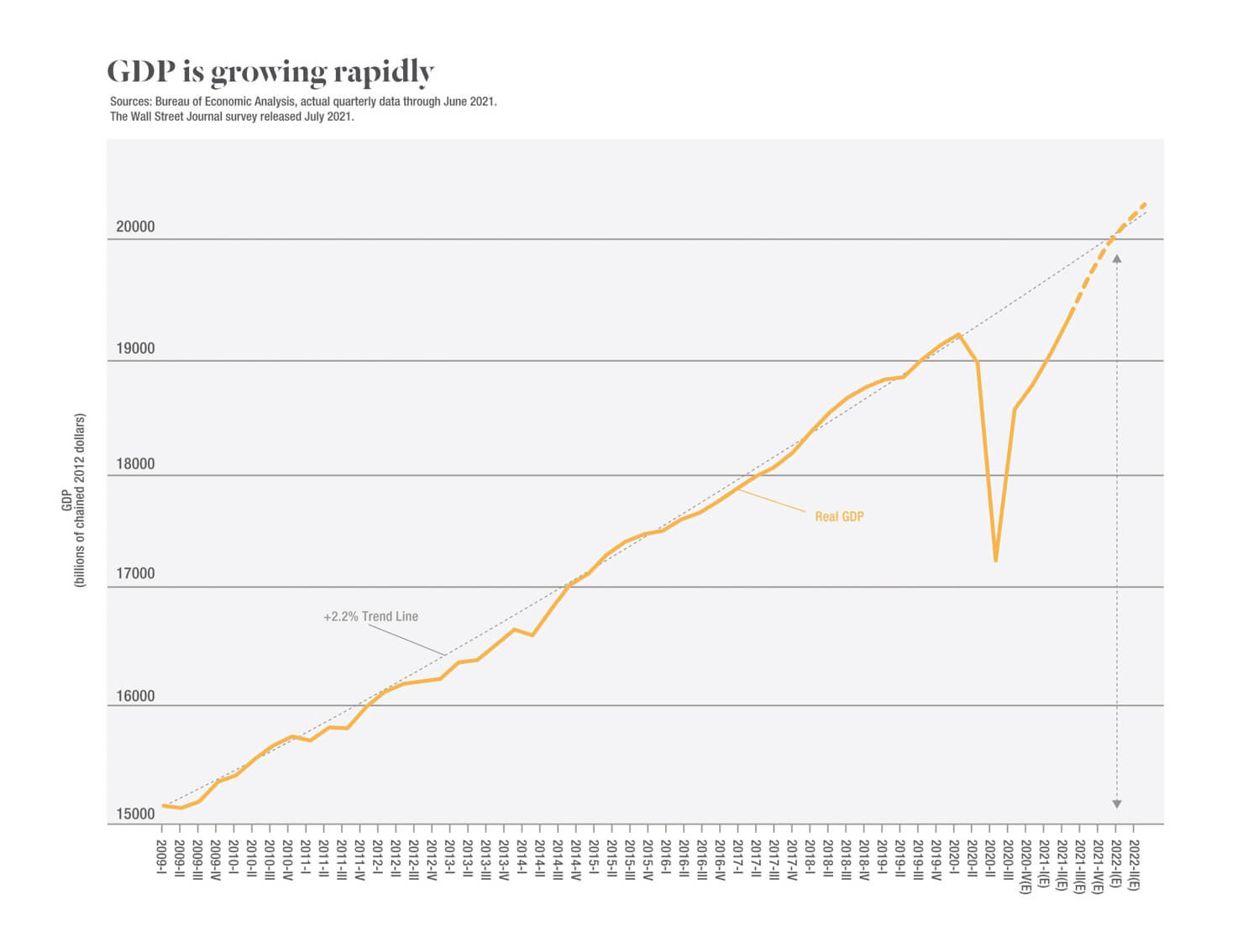

- The economy is growing, not shrinking. The US economy grew by 6.5% after inflation (13% before inflation) in the second quarter. Economists expect growth in the third quarter.

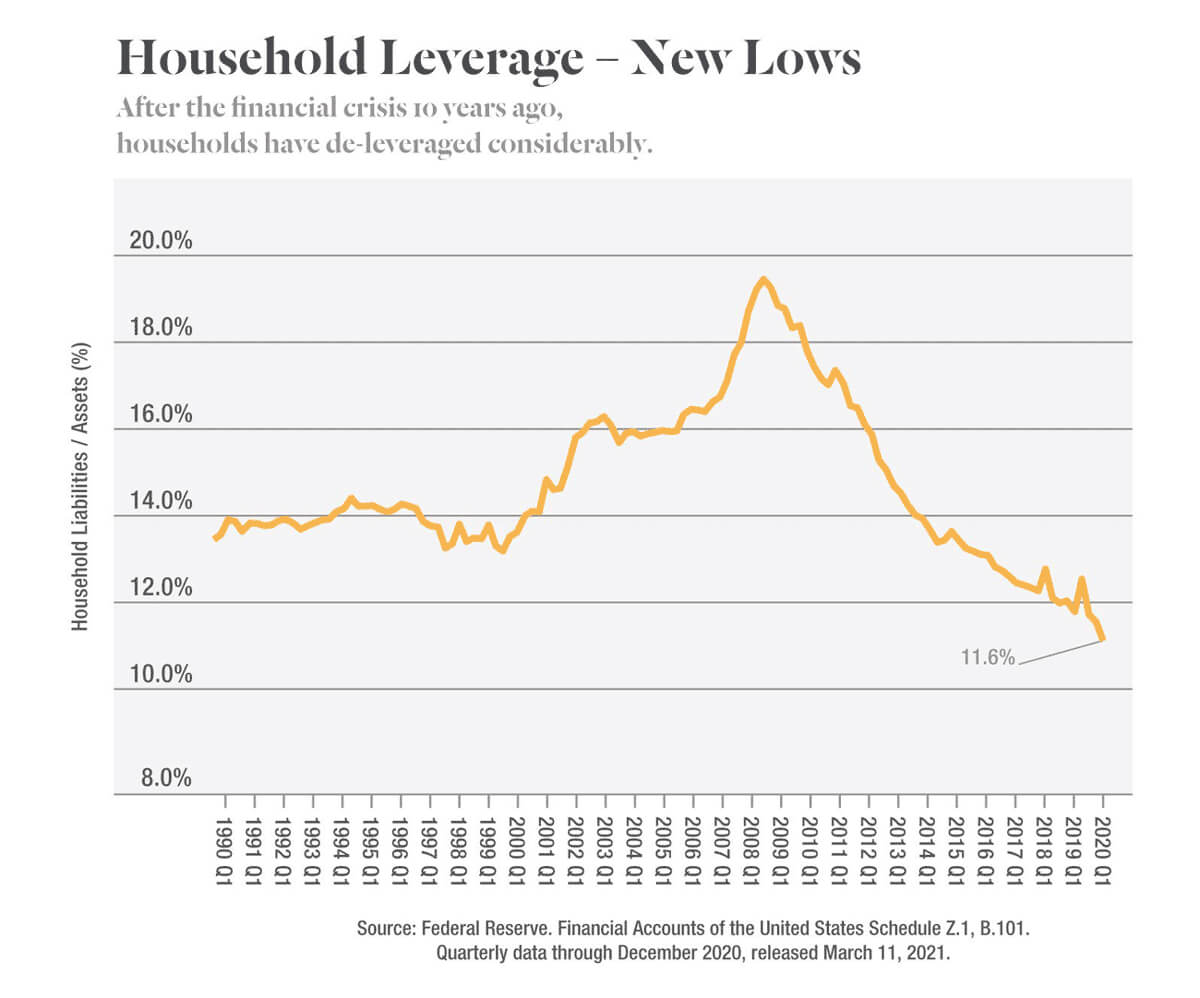

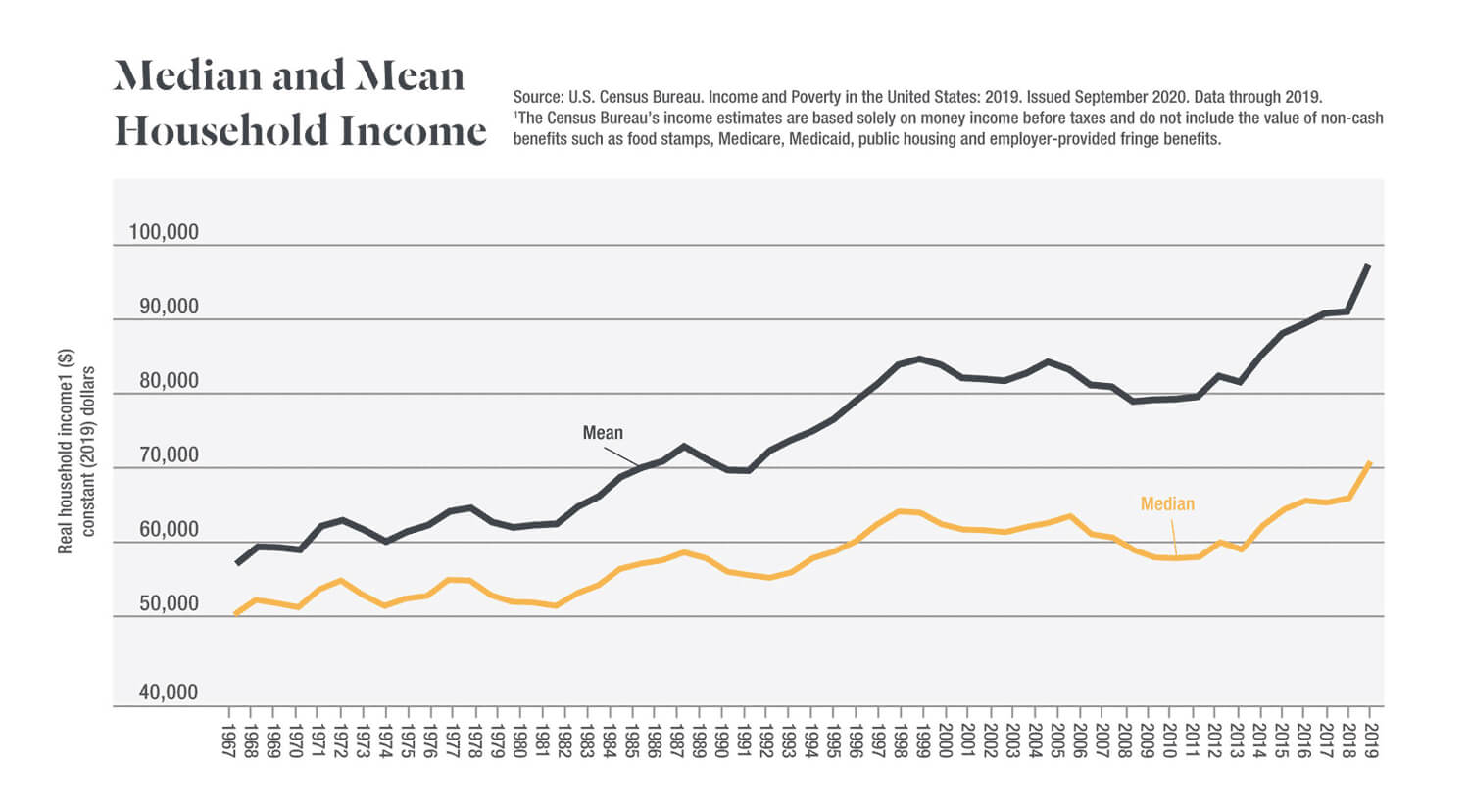

4. Mean and median incomes are at record highs and growing, while household debt relative to assets is at a record low.

4. Mean and median incomes are at record highs and growing, while household debt relative to assets is at a record low.

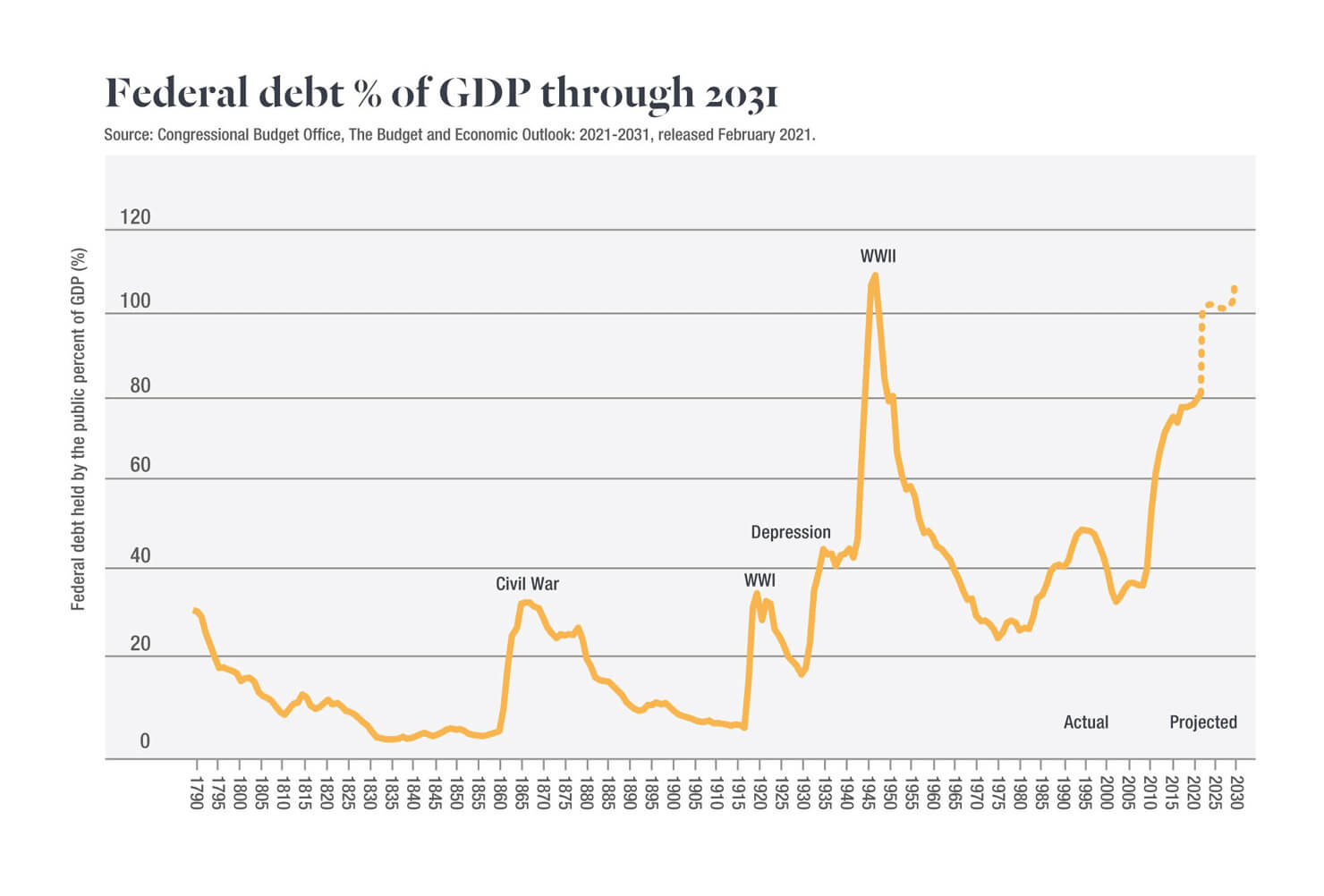

5. Government debt has spiked over the last year and continues to rise. The total US debt is projected to surpass 100% of GDP soon, which is considered to be a dangerous level. This is before we take on additional debt for an infrastructure bill or other proposed programs.

5. Government debt has spiked over the last year and continues to rise. The total US debt is projected to surpass 100% of GDP soon, which is considered to be a dangerous level. This is before we take on additional debt for an infrastructure bill or other proposed programs.

These data points all point to a rapidly growing economy that by no means requires additional support from debt-fueled spending. The question now is, can Congress go against its nature and slow spending?

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.