Data Tells A Story

Share This Insight

Data is the ultimate storyteller.

There is no deception in data, and no hiding from it, either. And right now the data is telling a very interesting story about what is going on in our economy.

There are three main characters in today’s data story:

- Inflation

- Interest Rates

- Employment

Inflation

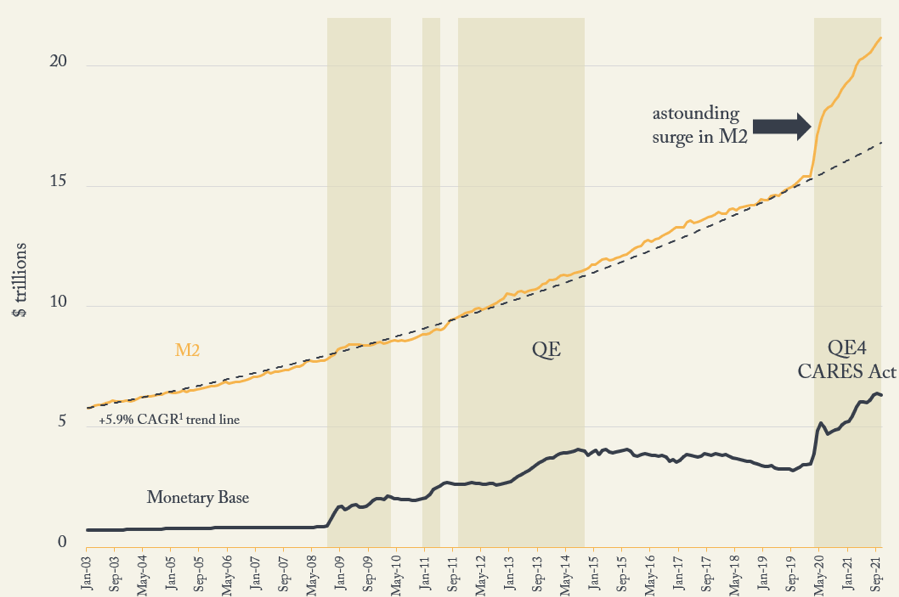

Inflation continues to run hot, increasing 7% in the last year. This is the most dramatic inflation the US has seen since 1982. Much of this has been driven by a massive increase in money supply (M2), as seen in the chart below. M2 is representative of all the money in checking, savings and money market accounts—essentially meaning all spendable dollars for Americans.

Source: Federal Reserve, statistical release H.6. Data through November 2021.1CAGR = compound annual growth rate.

This has caused a huge spike in consumer demand. Meanwhile, our economy has been simultaneously suppressed by COVID restrictions and debilitating supply chain bottlenecks.

The good news is that as money supply levels off, COVID calms down and supply chains are repaired, the data is pointing toward slowing inflation moving forward.

What does this mean for you? Some costs, like at the grocery store, gas pump and restaurants may continue to rise, but probably not as fast as 2021. Meanwhile, as supply improves, some other costs may see a decline, like new and used cars.

Interest Rates

The Federal Reserve, which influences interest rates, has made its intentions abundantly clear for the next year:

- Reduce its balance sheet

- Raise interest rates

This means The Fed will slow the pace of bond buying, eventually becoming a seller and thus reducing its own bond holdings and absorbing some of the excess money supply. At the same time, The Fed is planning multiple interest rate increases this year, with more to come in 2023. This sort of policy makes borrowing more expensive and capital less accessible within the economy.

These two tactics are appropriate in an inflationary environment. The problem arises with the timing. In our last blog post we examined how growth appears to be slowing. A tightening monetary policy going into an economic slowdown can be a cautionary sign for markets.

What does this mean for you? Rate hikes result in higher interest rates in your savings accounts. Balance sheet reductions can increase long-term interest rates, like mortgages.

Employment

Finally, unemployment rates have been declining, recently falling below 4% for the first time since before the pandemic. This is a good thing.

However, this number is misleading because it doesn’t take into account the “Great Resignation,” the trend of countless Americans taking early retirements or otherwise choosing to not work. This creates a lower Labor Force Participation Rate at only 61.9%. Therefore, the lower unemployment rate is not as encouraging as it should be because we have a shrinking active workforce. This causes jobs to remain unfilled, and as a result, companies are struggling to overcome the labor shortage.

What does this mean for you? You get the opportunity to practice patience as you experience slow service at your favorite restaurants and stores until the workforce returns to pre-pandemic levels.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.