Annual Portfolio Rebalancing

Share This Insight

Nobody knows what the future holds. This is true in many aspects of life, but it seems especially true for investing. Markets fluctuate, and there is no one investment style that always performs well in any given year.

From one year to the next, investment account performance is often seemingly random. Big-picture financial trends can make some years stronger than others in general, but it’s impossible to consistently know in advance which particular investments will come out on top.

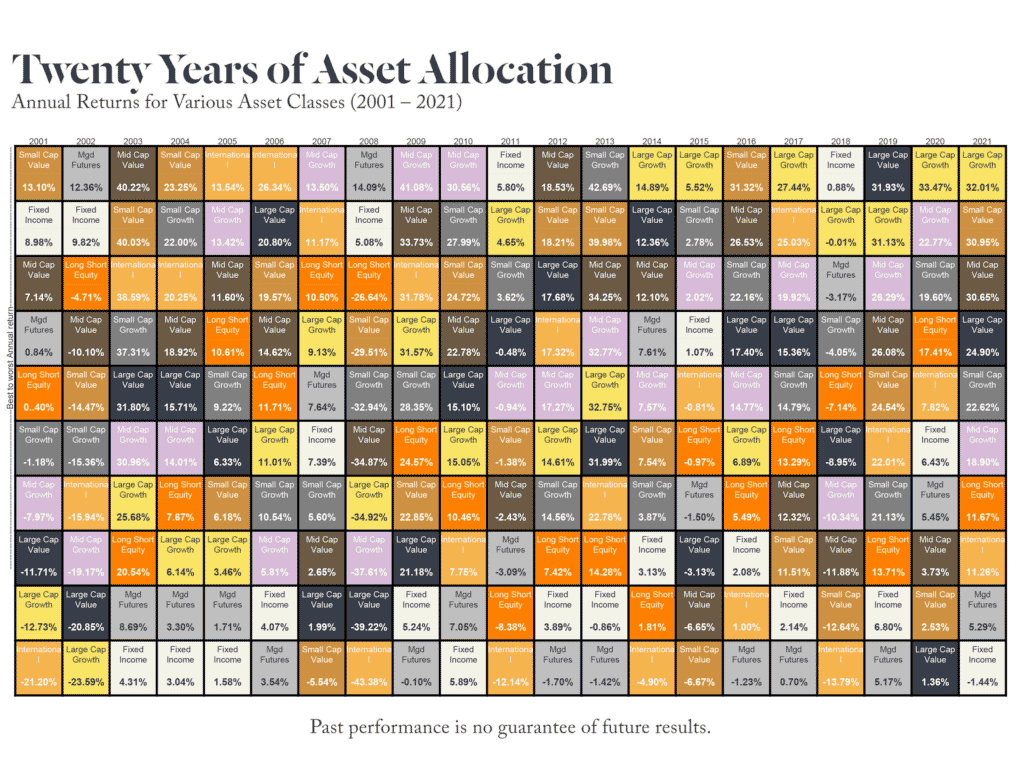

This table shows ten of the most common types of investments across twenty years. Each investment type is represented by a different color, with each column ranked in order of performance. You can see at a glance that there are no clear, predictable patterns. For example, Large Cap Value was the top-performing category in 2019 but came in absolute last in 2020.

Every category reflects a similar story. To put things simply, past performance truly is no guarantee of future results.

So, if there is no identifiable pattern to which types of investments are sure winners, how do you position yourself for the greatest potential for long-term growth? By diversifying your portfolio, and returning to it annually to rebalance your investments to maintain that diversity.

Why and How to Rebalance a Portfolio

Diversification means that your money is invested across a wide variety of investments to decrease the overall risk in your portfolio. This way, even if some investments perform poorly, others may do well. This is the age-old risk management strategy of not putting all your eggs in one basket. Your financial advisor can help you create a diversified portfolio that helps spread out risk and makes sense for your particular needs, based on your goals and timeline.

A diversified portfolio with an appropriate asset allocation only works as an effective investment strategy if you take steps to maintain it. This is where rebalancing comes in. Essentially, rebalancing means adjusting your portfolio back to a predetermined asset allocation by selling positions that have become overweighted and purchasing positions that have become underweighted. This allows you to take advantage of declines in under-performing areas and prevents your portfolio from becoming too top-heavy in any one category.

Perhaps most importantly, it sets you up with a more neutral starting position at the beginning of the year, allowing you to stick with the strategy you developed with your financial planner rather than being driven by the whims of the market.

Working with a Wise Financial Planner

Rebalancing is always important, but it’s especially essential during years with high volatility like this one. From stocks and bonds to cryptocurrency, commodities, and even real estate, almost every asset class we can think of has seen significant volatility this year. No matter how your portfolio looked at the beginning of the year, it will likely be out of balance now. Taking some time to review and adjust your investments can provide a more stable foundation for the new year.

Your annual rebalancing period is also a good time to reflect on your overall investment strategy and decide whether it’s working for you or if changes will need to be made. You’ll also want to apply rebalancing strategies to your investments that your financial planner did not help you set up, like your 401(k). In your taxable accounts, you will want to be mindful of the tax ramifications of rebalanacing. It would be wise to consult with your financial advisor or tax professional to discuss the most appropriate timing of your rebalance.

In many cases, a financial planner may take steps to rebalance and maintain an ideal asset allocation based on an investor’s age, risk tolerance, and goals. However, it’s best to discuss this strategy with your financial advisor and make sure you’re all on the same page. This might also be a good time to think about end-of-year tax strategies and whether any investment strategy changes, like tax loss harvesting, would make sense for you.

Index Definitions

S&P 500 Growth Index measures performance of the companies with higher price-to-book ratios in the S&P 500 Index; an unmanaged index of 500 companies in the large-cap range of the US stock market. Pre 2006 numbers are S&P /BARRA.Large Cap Value

S&P 500 Value Index measures performance of the companies with lower price-to-book ratios in the S&P 500 Index; an unmanaged index of 500 companies in the large-cap range of the US stock market. Pre 2006 numbers are S&P/BARRA.Mid Cap Growth

S&P Midcap 400 Growth Index measures performance of the companies with higher price-to-book ratios in the S&P Midcap 400 Index; an unmanaged index of 400 companies in the mid-cap range of the US stock market. Pre 2006 numbers are S&P/BARRA.

Mid Cap Value

S&P Midcap 400 Value Index measures performance of the companies with lower price-to-book ratios in the S&P Midcap 400 Index; an unmanaged index of 400 companies in the mid-cap range of the US stock market. Pre 2006 numbers are S&P/BARRA.

Small Cap Growth

S&P Smallcap 600 Growth Index measures performance of the companies with higher price-to-book, price-to-earnings, and price-to-sales ratios in the S&P Smallcap 600 Index; an unmanaged index of 600 companies in the small-cap range of the US stock market.

Small Cap Value

S&P Smallcap 600 Value Index measures performance of the companies with lower price-to-book, price-to-earnings, and price-to-sales ratios in the S&P Smallcap 600 Index; an unmanaged index of 600 companies in the small-cap range of the US stock market.

International

Morgan Stanley EAFE Index is an index of stocks compiled by Morgan Stanley Capital Intl. It consists of more than 1,000 companies in 21 developed markets. It is designed to measure performance for the developed markets of Europe, Australia, and the Far East and is generally considered representative of the international stock market.

Fixed Income

Bloomberg Barclay’s Intermediate Government/Credit Index is a measurement of approximately 2800 corporate, publicly traded, fixed-rate, nonconvertible, domestic debt securities and debt securities issued by the US government or its agencies with maturities between 1 and 9.99 years.

Long Short Equity

HFRI Equity Hedge (Total) Index - Funds included in the index include investment managers who maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be widely diversified or narrowly focused on specific sectors and can range widely in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. Equity hedge managers would typically maintain at least 50%, and may in some cases be substantially or entirely invested in equities, both long and short. Information on this index is available at hedgefundresearch.com

Managed Futures

Barclays CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. There are currently 510 programs included in the calculation of the index for the year 2020, which is equally weighted and rebalanced at the beginning of each year.

Disclosure

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.