To Risk or Not to Risk?

Share This Insight

As you’ve undoubtedly noticed, 2022 was a big year for interest rate hikes. All told, the Fed raised borrowing rates seven times last year, ending with interest rates higher than they’ve been since 2007. The purpose of these interest rates is to slow economic growth and reduce inflation.

There is an expected but welcome side effect to those rate increases: rates of return on savings, money market, and treasury bonds tend to rise. We’re seeing that now. Safe, short-term investments that yielded less than 1% before 2022 jumped now to 4% or higher in some instances, providing a higher rate on savings than we’ve seen since 2008.

If you can grow your money by 4% in a safe, risk-free vehicle like a savings account, why would you want to take a risk on the stock market? Isn’t a guaranteed return better than risking a loss?

Well, not necessarily. Before you write off investing in the current market, it’s worth considering your options in the context of your goals.

Bull and Bear Markets

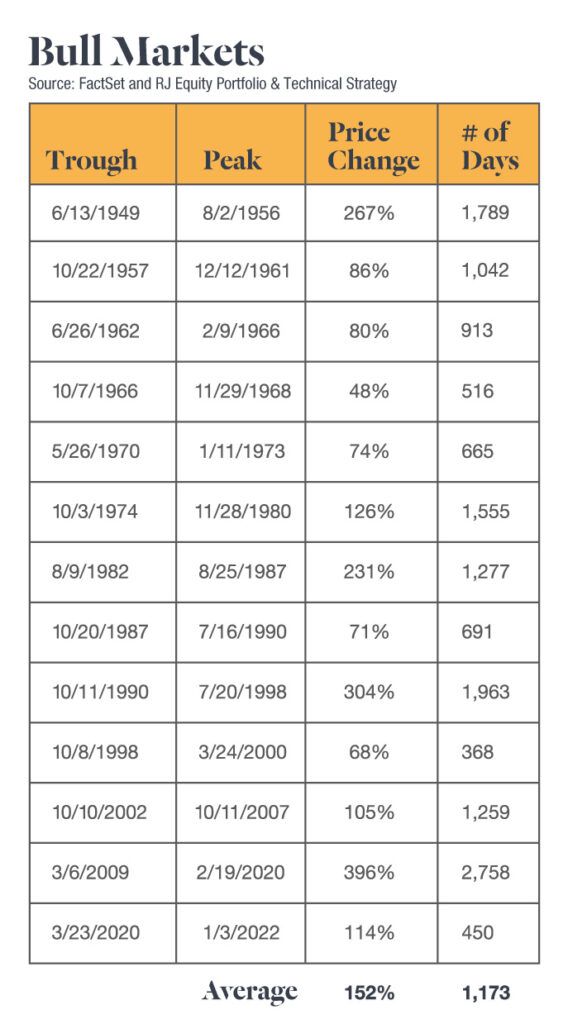

Historically, market fluctuations have been cyclical, with peaks and troughs. Some recovery periods are longer than others, but the pattern established throughout history has been one of overall growth. In fact, on average, the peaks have shown over 150% growth from the bottom of the valley:

While we can never time a bottom, markets have always bounced back quickly and often before economic data or sentiment improve. Avoiding investments today – or, worse, pulling funds out of stock investments – could mean missing that profitable recovery period. With a possibility of 150% or more in return on long-term investments, that 4% risk-free growth doesn’t seem nearly as attractive.

Stocks Can Still Provide a Better Long-Term Rate of Return

Risk is inherent to the nature of the stock market. Even in up markets, investments can carry some measure of risk. However, the trend has been one of reliable recovery and long-term growth.

The question of where to put your money is best decided by your investment strategy and timeline. Short-term savings goals, like saving up for a vacation or new car, might take a year or two to reach. In that scenario, a risk-free option is appropriate.

Long-term investment goals, such as retirement savings and generational wealth management, are much better suited to market investment. When there is less need for liquidity, you can keep funds in investments that carry greater risk and a higher possible return. In the long term, this type of investment can create substantially more wealth to better help you serve your financial goals.

Risk Tolerance and Fear

After a few uncertain and tumultuous years, it’s understandable to be experiencing some fatigue. With interest rates higher than they’ve been in recent memory, the urge to avoid risk and cash in on an easy 4% gain might be quite tempting. But it’s important not to fall into the grip of emotional decision-making. Recency bias and a fear of loss can cloud your judgment, cutting you off from valuable opportunities.

Here's a Warren Buffett quote that you may have heard: “Be fearful when others are greedy, and greedy when others are fearful.” In other words, it can pay to move against the current of what others are doing. When others are greedy, prices can rise and increase the risk of overpaying for an asset. But when others are fearful, there can sometimes be significant opportunities for investments.

The Bible shares similar wisdom. The “Parable of the Talents,” as told in Matthew 25:14–30 makes a case for growth over fear. We are not called to be fearful and hide our resources, but to work toward growth. Taking calculated investment risks where appropriate and in service to a strategic plan will bring you closer to your goals than always choosing to play it safe.

If you’re feeling some uncertainty with the market or need help with figuring out your financial goals, working with a certified financial planner can help. The Certified Kingdom Advisors® at John Moore Associates can help you better understand your options and help you cut through the noise of fear and uncertainty so that, together, we can craft a plan that makes sense for your needs. Reach out to speak with a financial planner in Albuquerque, NM or Scottsdale, AZ.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.