Navigating the Complexities of the SECURE 2.0 Act

Share This Insight

In 2019, the “Setting Every Community Up for Retirement Enhancement” (SECURE) Act sought to close the retirement savings gap and help more people save. This year’s SECURE 2.0 Act builds upon that foundation with a robust package of new rules designed to provide more opportunity and flexibility to workers planning for retirement.

This is a hefty piece of legislature, with over 90 changes planned to go into effect over the next decade. The flexibility it offers will be a blessing for many seeking to boost their retirement income and achieve other financial goals, but that flexibility also creates greater complexity.

Below, we’ll look at a few highlights of the new act. For more information about how your specific financial situation may be impacted, and what opportunities you may now be eligible for, you can reach out to speak with our Albuquerque and Scottsdale financial advisors for personalized guidance.

The Big Picture

Overall, the goal of SECURE 2.0 is the same as its predecessor: closing the savings gap by making it easier for people to set money aside for retirement. To that end, a number of incentives have been put in place for employers and workers alike to encourage saving. There isn’t enough room to explore all of the proposed changes, but we’ll touch on some of the highlights as they apply to workers, employers, and those ready for retirement.

Highlights for Savers

Traditionally, many workers find themselves in the challenging position of choosing between saving for retirement and tackling other financial goals like debt repayment or emergency savings. The new act offers a few solutions that allow savers to do both.

One option is a student loan match program. This would allow individuals to make payments toward their student loans, with their employer making a matching contribution into a 401(k), 403(b), or Simple IRA. In other words, you can pay down your student loan debt while your employer contributes funds toward your retirement.

Another option is to use employer matching to build up emergency savings. Employees could put a payroll deferral of up to $2,500 annually into a designated Roth account, which would allow for penalty-free withdrawals as needed for emergencies. Just like with the student loan program, employers could direct matching contributions toward a retirement plan.

Individuals with a 529 college savings plan can convert up to $35,000 unused plan dollars into a Roth account. This is a great option for individuals freshly entering the workforce as a way to jumpstart their savings.

Workers approaching retirement between the ages of 60 and 64 are also allowed to make larger catch-up contributions to help bolster their retirement savings.

Highlights for Employers

Several changes within the act are designed to encourage small businesses to offer more retirement options and to make those plans more accessible and affordable to establish. For example, there are new tax incentives for creating retirement plans, such as a 401(k), 403(b), or SIMPLE IRA.

For sole proprietors, retroactive contributions to newly established 401(k) plans are now allowable up until Tax Day.

Additionally, there are multiple new avenues to fill the Roth savings bucket. For instance, Roth options have been made available for all contributions into SIMPLE IRAs and SEP IRAs. Other changes include increased contribution limits for small business plans, a change to matching requirements, and an easing of the “top-heavy” rules.

The SECURE 2.0 Act also makes 401(k) auto-enrollment the default for all employers, with employees opting out rather than opting in. The idea is to encourage people to save by minimizing barriers to entry.

Highlights for Retirees

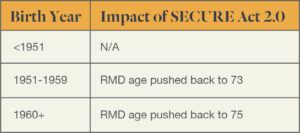

One of the biggest and most talked-about changes brought on by SECURE 2.0 is that the age for required minimum distributions (RMD) from retirement accounts has been pushed back yet again. Retirees can still begin withdrawing penalty-free from their plans at age 59 and a half, but RMDs are not required until age 73 or 75, depending on your birth year. With people living longer and retiring later on average, this flexibility could prove quite valuable for many.

If for any reason a retiree fails to satisfy their RMD in a calendar year, the tax penalties for such a mistake have also been reduced.

Surviving spouses who have inherited IRAs have also gained more flexibility (and complexity) in how to manage those distributions. And for those making charitable contributions part of their wealth management strategy, qualified charitable distributions (QCDs) have an annual inflation increase, the first such increase since they were introduced in 2006.

Guidance and Support Needs to be Personalized

Not every change will affect every individual, but the vast majority of Americans are poised to be affected in some way by this act. For some people, new opportunities have opened up to explore. Others may need to re-think their savings strategies to maximize their potential.

Whatever your individual scenario, you are likely to face decisions moving forward that you hadn’t before. A financial planner can help guide you through these choices and help you create a plan that will allow you to best reach your goals.

John Moore Associates is here to help you cut through the confusion of complexity with principled counsel and personalized financial planning advice. For more information about the SECURE 2.0 Act and how it might affect your retirement plans, be sure to tune in to our webinar on March 30 at 4 p.m. MST.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.