Market Volatility During Midterm Elections

Share This Insight

“Therefore do not worry about tomorrow, for tomorrow will worry about itself. Each day has enough trouble of its own.” – Matthew 6:34

This has been a big year for challenging economic news. There’s a lot of negativity in reporting, from talk of recession to discussion of inflation, interest rates, and the overall slowing economy. Adding to that is politically charged rhetoric as we turn the corner into the midterm election. With 36 of 100 US Senate seats, 36 state governor races, and all 435 House seats up for voting, there is a lot of uncertainty about what will happen after November 8.

But although the word “unprecedented” tends to come up in these discussions, the fact is that much of what’s currently happening in the financial market mirrors known patterns from previous election years. And when it comes to making financial decisions in the face of uncertainty, our financial advice is the same as ever: invest according to your values and goals.

Financial Markets Don’t Like Uncertainty

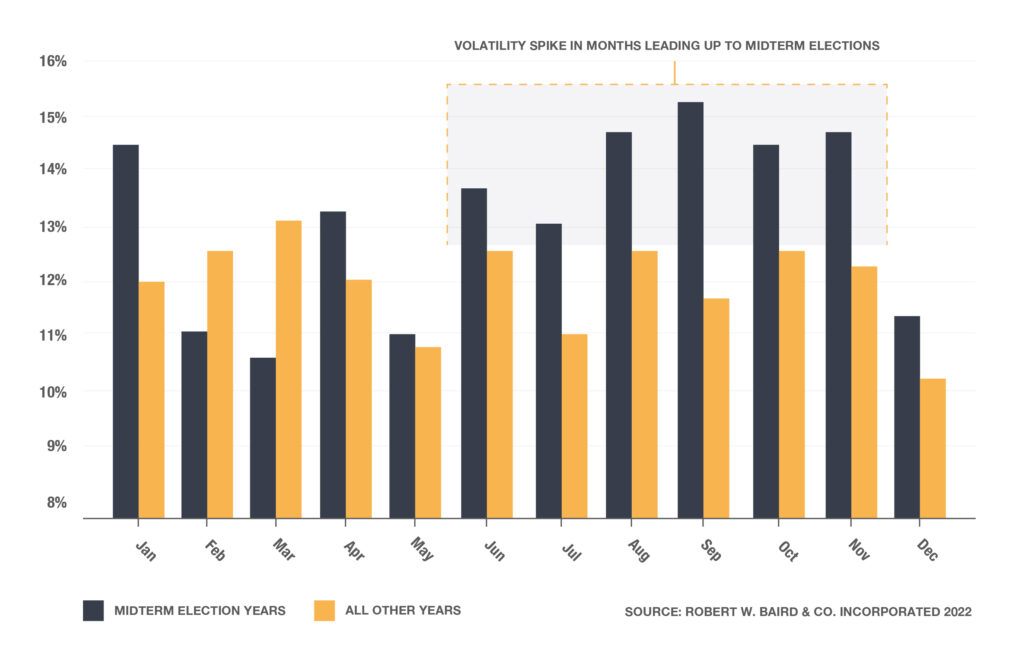

It’s not uncommon for the market to slow down in the lead-up to an election. According to US Bank, the S&P 500 Index has historically underperformed in midterm election years. The average annual rate of return before midterms is 0.3%, with an average rate of return of 16.3% in the 12 months after the election. Obviously, the exact numbers vary from one election to the next, with some years seeing more volatility than others, but the overall pattern is quite consistent:

This pattern repeats with each election, regardless of what party is in power or what policies could be enacted. Why is that? Because markets do not like uncertainty, and until an election outcome is decided, no one knows what policy changes are likely to happen. That uncertainty leads to volatility, which leads to temporary market declines. Once the election is decided and policies become easier to predict – regardless of which party is in power or what those policies might be – the market tends to stabilize.

History Does Not Repeat, But It Often Rhymes

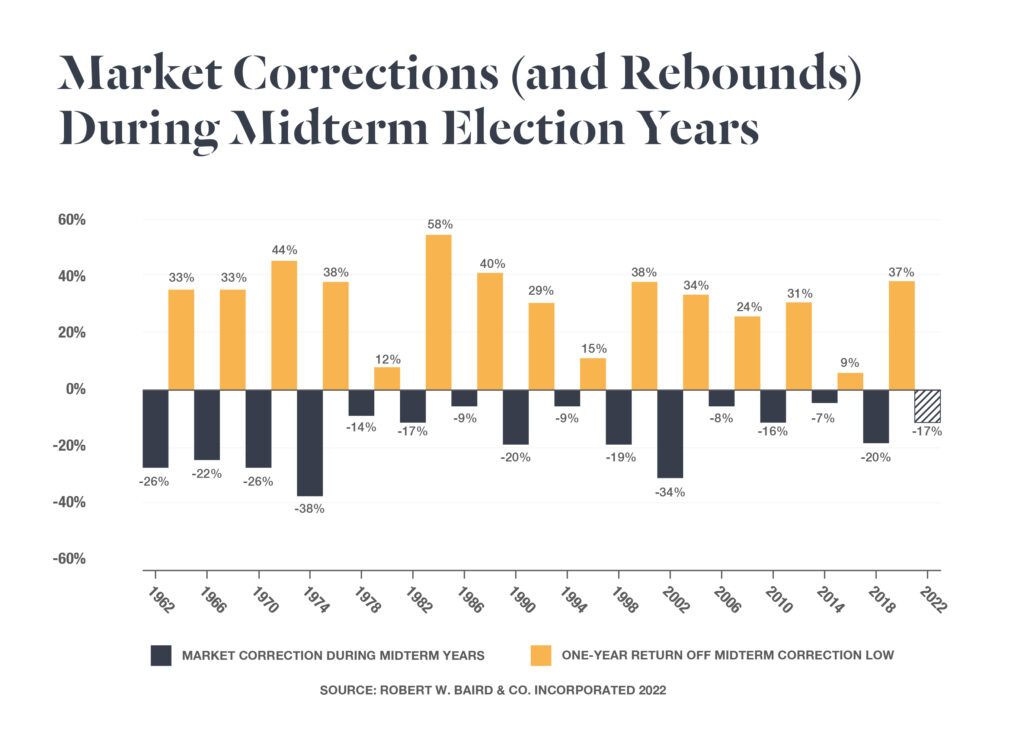

The good news in all of this is that these midterm election year market declines are, more often than not, followed by a recovery phase. The S&P 500 has not declined in the year after a midterm election since 1946. Going back to 1962, the average correction in midterm years is 17.9% and 32% up from the bottom one year after the midterms.

Of course, it’s too early to tell whether and how much the market might rebound, and the election is just one piece of a greater financial puzzle. But if you’ve stayed the course so far throughout this year’s volatility, there’s no reason to change tactics now.

Let Your Financial Plan Be Your Guide

We’ve talked in the past about how markets are leading indicators of the economy. Current events and projections are already priced into the market, and its performance will usually begin to improve well before the news cycle catches up. Most importantly, you miss the often-lucrative recovery phase when you pull your investments during troubled times.

A much better and less stress-inducing investment strategy is to ignore the bumps and day-to-day uncertainties and focus on the big picture. A strong, diversified portfolio built around your long-term financial goals will help you weather most storms and continue to accrue in value over the long term.

Having a personal financial plan for your money allows you to choose the investments that make sense for your needs and timeline, rather than allowing uncertainty and fear guide your decision-making. If you’re not sure what you should do next or need help with creating a financial strategy that protects your assets while helping you pursue your long-term and short-term financial goals, a John Moore Associates financial planner can help. Reach out today to get started.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.