Turbulence in the Current Bond Market

Share This Insight

The bond market has historically been seen as a more conservative safe haven for investors when compared to the stock market. As we’re currently seeing, however, bond prices can also experience volatility. If you’re seeing red in unusual places as you review your investments, some of that turbulence may be to blame.

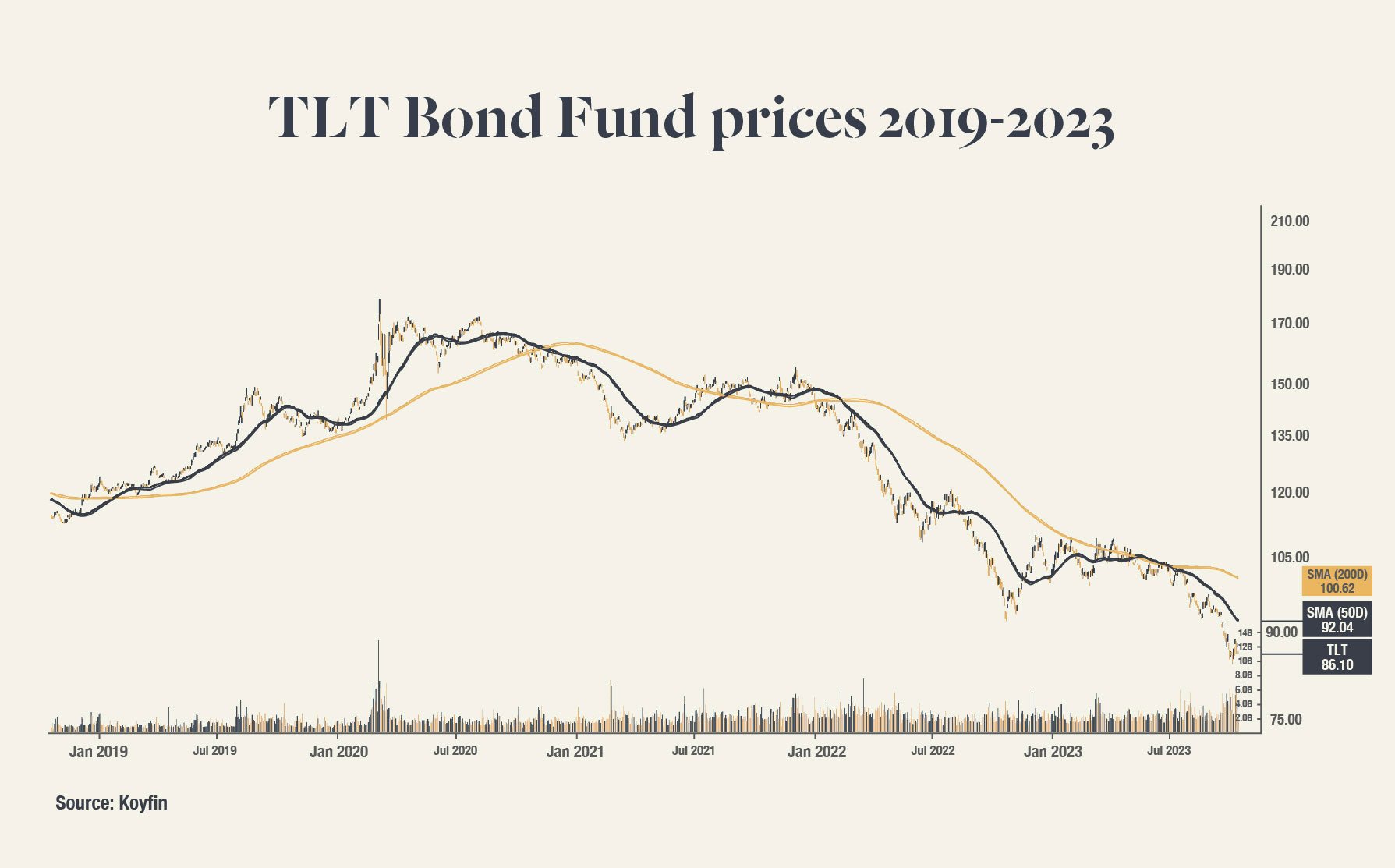

The bond market is currently experiencing one of the worst losses in history, and certainly the worst in living memory. The exchange-traded fund TLT, which represents the long-term treasury bond market, has dropped by 50% since its peak in August of 2020. A similar pattern repeats across portfolios heavily invested in bonds.

What’s driving these circumstances? Should you be worried? What steps should a wise investor consider next? Let’s explore these and other questions you may have about the bond market.

How Do Bonds Work?

Before we can understand the current situation, it helps to understand what bonds are and how most bonds function. Essentially, a bond is a loan you provide to an entity, such as a municipality. In exchange, the bondholder receives periodic interest payments. After a fixed period, the bond “matures” and the initial investment is returned.

Because bonds can take some time to mature, they are often bought and sold on the market as secure investments. Their value at maturity, called the “par value,” is fixed and guaranteed. But the performance of the investment can and will vary based on interest rates from year to year, which in turn can also affect its sale value. That’s what we’re seeing currently.

What’s Driving the Change in Bond Prices?

Bond prices have an inverse relationship with interest rates because the bond market responds to supply and demand. Bonds pay a fixed amount of interest, called a coupon rate, for their lifetime. If you had a bond with a 5% interest rate, but new bonds are issued with a 6% interest rate, your bond becomes less attractive to investors and is worth less on the open market. Conversely, when interest rates decrease, existing bonds become more valuable because their fixed interest payments are more attractive in a market with lower rates.

We have recently experienced an unprecedented rapid rise in interest rates. After a 12-year period of consistent interest rate decreases, the Federal Reserve has dramatically raised interest as a tool against inflation. Not only are interest rates higher than they have been in some time, the rates increased at an unusually fast pace. As a result, the bond market has had to adjust very quickly, and bond prices have gone down across the board.

So What Do We Do Now?

As alarming as it may feel to see your “safe” investments performing poorly, this is not a time to panic or take hasty action. It’s tempting to sell underperforming investments, but that’s a formula for more losses. Instead, look at this as an opportunity to purchase bonds at the lowest prices in years.

Just like the stock market, the principle of “buy low, sell high” applies to the bond market. If it makes sense for your goals and financial plan, now could be a good opportunity to tilt your allocation towards bonds in anticipation of future interest rate changes. The Federal Reserve appears to be done increasing interest rates, so we should be seeing more stability in that area moving forward.

Our recommendation for many investors is to hold onto any bonds you currently own, and consider purchasing more if it’s appropriate for your plan. But every investor’s goals and needs are different, which is why we encourage you to reach out to an Albuquerque or Scottsdale financial advisor. A John Moore Associates advisor can review your current investments, discuss your goals with you, and create a plan that will best fit your needs in these ever-changing financial circumstances.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.