Today’s Top-Heavy Market

Share This Insight

If you’ve been keeping an eye on market news this year, you may have noticed the trendline for the S&P 500 looks a bit different than what you’re probably seeing on your investment returns. You might also be a bit confused about what direction things are heading.

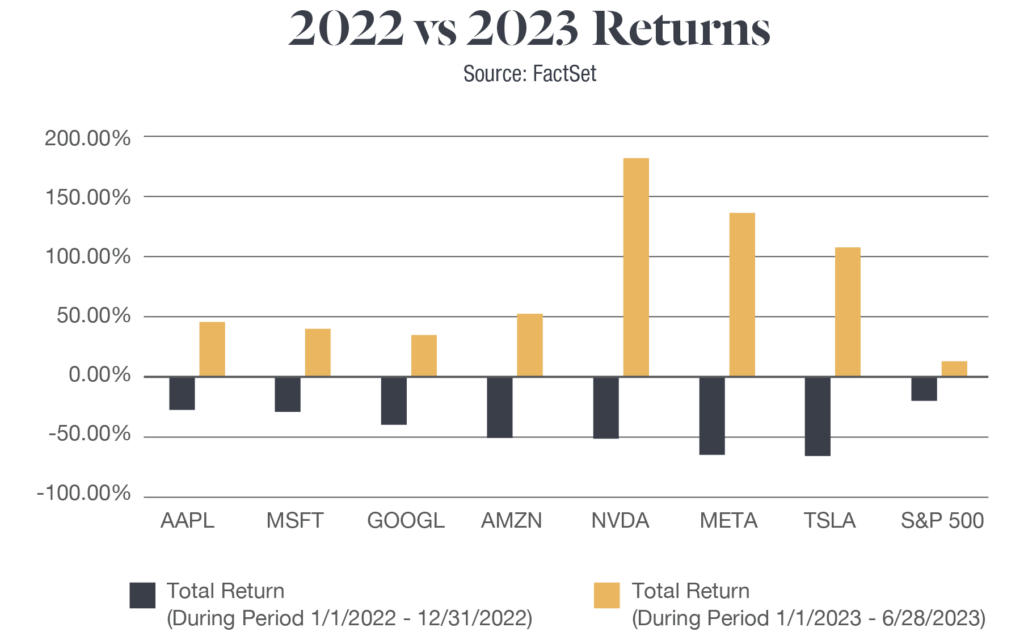

Despite talk of recession and the failure of two regional banks in March, the S&P 500 was still up 9% by the mid-year mark. Yet many investors haven’t seen a similar rate of return, and the overall economy still shows signs of cooling. What’s going on?

A closer look at the index starts to show a clearer picture. The seven highest-performing companies on the S&P 500 account for more than 80% of the gains this year. These “Magnificent Seven” big tech companies – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – as a group were up 44% at the end of May. But if you set those aside, the other 493 companies on the S&P 500 together were up just 1%.

Because the S&P 500 is weighted by market cap, massive corporations have an outsized effect on the overall index returns. The effect is dramatic, but it’s less consequential than you might imagine. In many ways, these high-performing tech companies are masking the big-picture view of what’s actually happening with the market, and in the economy at large. And for investors anxious about their retirement fund or wondering how to make the next move, that kind of obfuscation can cause a lot of extra stress and confusion.

The Problem with Benchmarking Yourself to the Market

When you have substantial assets tied to investments, it’s easy to fall into the trap of worrying over their performance and second-guessing your decisions. But it’s important to take a step back and recognize that the short-term trends of the market don’t really matter much in the grand scheme of things. The ebbs and flows that make headlines don’t have much bearing on a good, diversified portfolio.

The goal of personal investing isn’t to “win” at the stock market. It’s to grow your wealth over the long term by balancing risk and reward.

At any given moment, some of your investments will perform well, and others will not. Over time, the growth trajectory has historically trended upward. But interfering with a well-designed strategy – for example, by cashing out and trying to chase growth by investing in “hot” stocks instead – is more likely to lead to disappointment.

As a stark example of why this is important, you don’t have to look back very far in history to see a very different picture of the market.

Just last year, these major tech companies were substantially down. The growth they’re currently enjoying, while impressive, is unlikely to last forever. They will continue to be very valuable, big players in the S&P 500 due to their sheer size in market cap, but they are by no means a foolproof investment for guaranteed, consistent growth. No company is.

Choosing a Principled Investment Strategy

Ship your grain across the sea;

after many days you may receive a return.

Invest in seven ventures, yes, in eight;

you do not know what disaster may come upon the land.

Ecclesiastes 11:1-2

Diversification is protection against uncertainty. If you’re familiar with the idea of not putting all your eggs in one basket, you’ll understand why we advise spreading out your investments broadly. A diversified portfolio is not selected at random, however. There is a great deal of science that goes into a wise investment strategy.

At John Moore Associates, we use a proprietary process to run a weekly quantitative analysis on the market. This helps us to identify possible trends and get a clearer big-picture view of the health of individual companies and the overall market. We do not allow short-term performance of trending companies or sectors to distract us from timeless principles, such as diversification. We take a broader view, with a focus on understanding market history and probable long-term results.

This measured approach helps us to gauge risk and match an investment to the level of risk a client is willing to assume. That allows us to offer guidance based on their goals and unique situation, not the whims of the market or superficial trends.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.