Understanding Interest Rates

Share This Insight

Since March of 2022, when the Federal Open Market Committee enacted the first of many interest rate increases, interest rates have been at the forefront of many people’s minds.

Discussion dominates news channels and dinner table conversations alike. And with that discussion can come uncertainty and questions: Are interest rates high right now? When will interest rates go down? What do today’s interest rates mean for me and my finances?

Let’s cut through some of the noise to explain what we really mean when we talk about interest rates, place the current financial conditions in a broader context, and provide some practical wisdom for your family and finances in the current market.

What Do We Mean by Interest Rates?

In general terms, “interest rate” means the price you pay to borrow money. Interest rates are generally expressed as an annual percentage of a loan you must pay back in addition to the principal. The higher the interest rate, the more expensive the loan.

In the context of the broader ongoing discussion, though, when people talk about interest rates going up or down, they are most likely referring to the federal funds rate. This is the rate commercial banks can use when they borrow from each other. This affects the rate of return on short-term investments like CDs, money market accounts, savings accounts, and so forth. It also affects most debts, like credit cards, lines of credit, car loans, and mortgages.

The federal funds rate is set by the Federal Open Market Committee (FOMC), the policymaking body of the Federal Reserve System (“the Fed”). Adjusting interest rates is one of the ways the Fed can help stimulate or cool the economy, as raising and lowering the cost of borrowing and investing affects nearly everything.

Why Is Everyone Talking About Interest Rates?

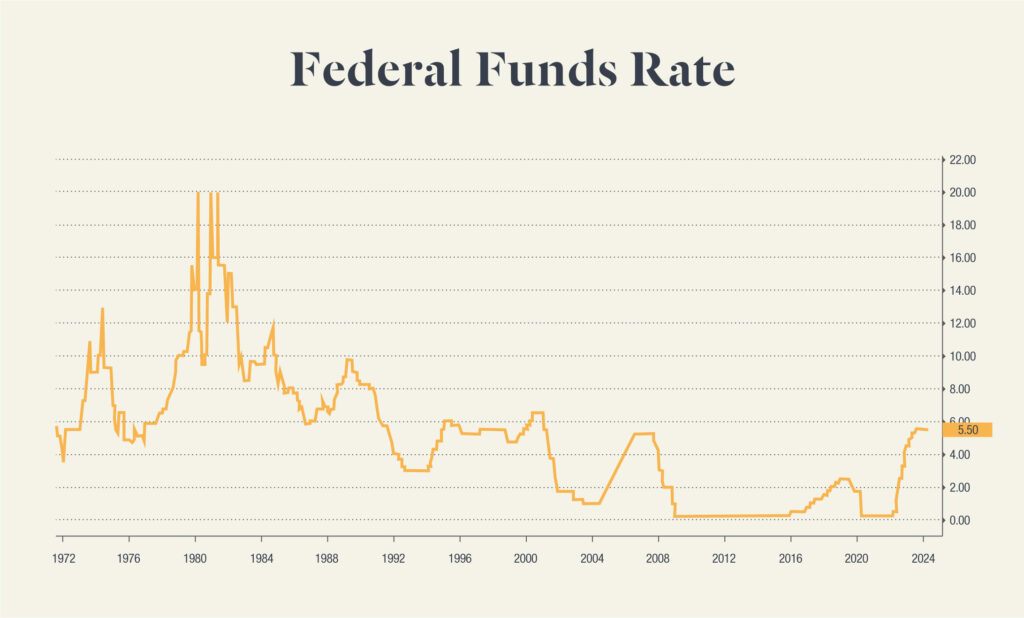

As of today, the fed fund rate is around 5.25% to 5.50%. In the grand scheme of things, this is far from the highest our interest rates have been in the U.S., but it is the highest it’s been in more than 20 years. For much of recent memory, we’ve seen near 0% interest, so the increase is noteworthy.

The Federal Funds Rate from 1972 to 2024. Source: Koyfin.com

So why did the Fed increase interest rates in 2022, and why do they remain where they are? Predominantly as a measure for controlling inflation.

You can think of interest rates as a sort of gas pedal for the economy. Dropping interest rates is like stepping on the gas to speed up the economy by encouraging borrowing and spending. Raising interest rates is like easing off the gas or even stomping on the brake. It slows the economy by discouraging borrowing and encouraging saving, removing money from circulation, and helping to bring down inflation.

The COVID-19 stimulus poured a lot of money into the economy, which was one major factor in the inflation we’re seeing today. There were just too many dollars chasing too few goods. The Fed’s rate hikes were meant to bring that inflation down, and we’re unlikely to see interest rates fall again until the economy cools. This could present itself in a number of ways: the unemployment rate could increase, decreasing inflation could slow down economic growth, or we could even enter into a recession.

What the Yield Curve Tells Us

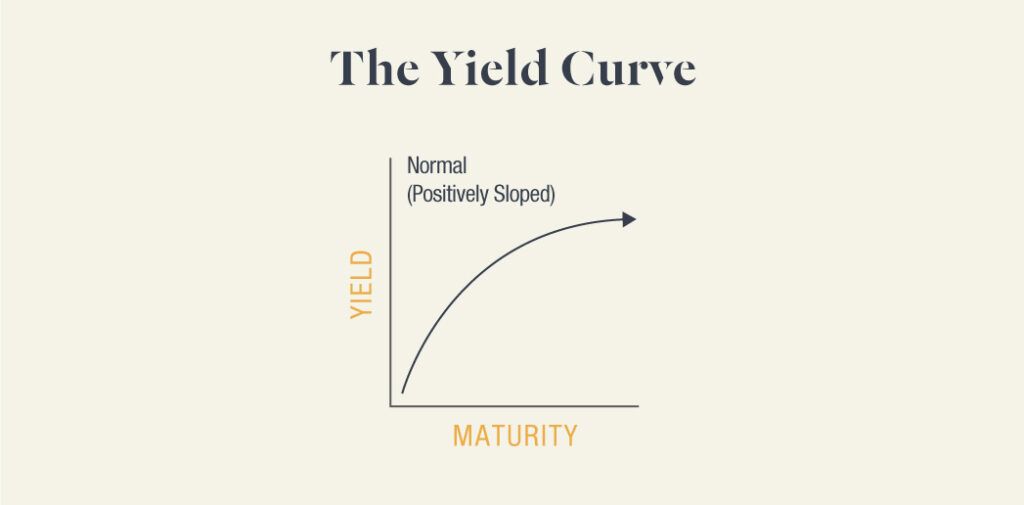

Something you may hear referenced in discussions about interest rates and the economy is the yield curve. This refers to the overall shape of short-term and long-term interest rates when plotted on a graph, with interest rates (or “yield”) on the Y axis and the length of the loan (“maturity”) on the X axis. Since short-term lending tends to carry less risk than long-term loans, a normal yield curve should look like this:

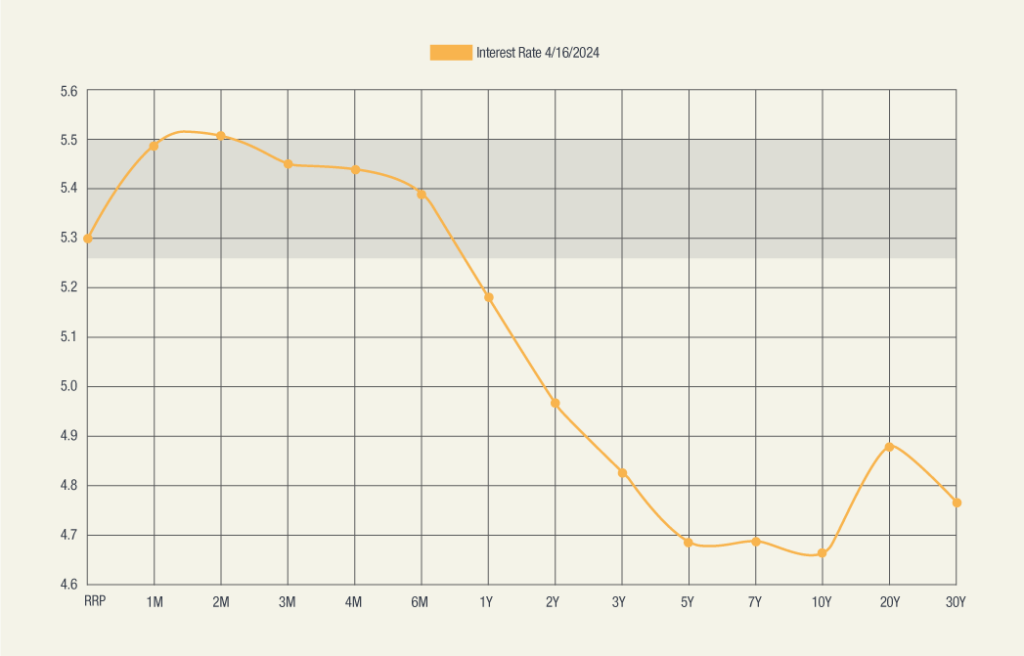

Presently, our yield curve looks like this:

Graph source: U.S. Treasury Yield Curve

This is what is known as an inverted yield curve, where the interest rate for short-term bonds is actually higher than long-term ones.

Historically, an inverted yield curve has been a strong indicator of impending recession . However, it’s not clear how long after the inversion before the recession might begin. Generally, once the economy has cooled or even entered into recession, that is when the Fed begins to take its foot off the brake (high interest rates) and put its foot on the gas (cutting interest rates). This would help normalize the yield curve by pushing shorter term interest rates down.

To start this year, the market was expecting seven rate cuts this year and was nearly certain they would begin in March. Fast forward to today: we have not had any rate cuts yet, and the market is expecting three rate cuts beginning in June. It’s also not out of the realm of possibility that we could even see another rate increase if this recent upward trend in inflation continues.

Practical Actions to Consider

So, what should you do in the face of this current environment? That’s a question that depends largely on your individual goals and financial situation, but there are a few actions we might advise our clients:

- Consider bonds as an investment. As we’ve talked about before, periods of high interest make bonds more appealing. Bonds are particularly attractive in times where interest rates could be reduced in the near future. Now could be a good time to diversify by adding bonds to your portfolio.

- Take advantage of high-yield savings accounts for your cash. If you’re not earning at least 4% on your savings account, look for an alternative with a higher yield. Money market accounts and CDs are another option for storing wealth and harvesting interest in the relatively short term.

- Avoid taking on any new variable debts if you can avoid them. Now is a good time to focus on paying off credit cards, personal loans, or home equity lines of credit to avoid accruing more interest.

Also, be sure to tune in for our weekly Investment Committee Insights videos for a quick snapshot of the market, keeping a finger on the pulse of developments that could affect your financial life.

As always, the best financial plan is one you make with the help of an advisor who understands your unique circumstances. Reach out to our financial planners to begin creating a plan that works for you.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.