Understanding Markets in Election Years

Share This Insight

There’s no denying that politics and financial markets are inextricably linked. The market responds to the economy, and the economy responds to political policy.

From legislation and tax reform to domestic and foreign policy, political decisions affect the economy, the consumer, corporate profits, and, ultimately, the price of stocks.

With an election around the corner and growing uncertainty about what the next four years might hold, it’s understandable to have questions about what to expect with your investments.

While history doesn’t repeat itself, it often rhymes, so here is some perspective to help you better understand how the market historically behaves during election years.

Stock Market Trends in Election Years

Uncertainty, whether political or economic, tends to create market volatility. That volatility can frequently result in a decline in stock prices. We’ve previously talked about this in the context of midterm elections, which historically show a trend of higher-than-average volatility with notable pullbacks leading up to mid-terms and a strong recovery after the outcome is decided.

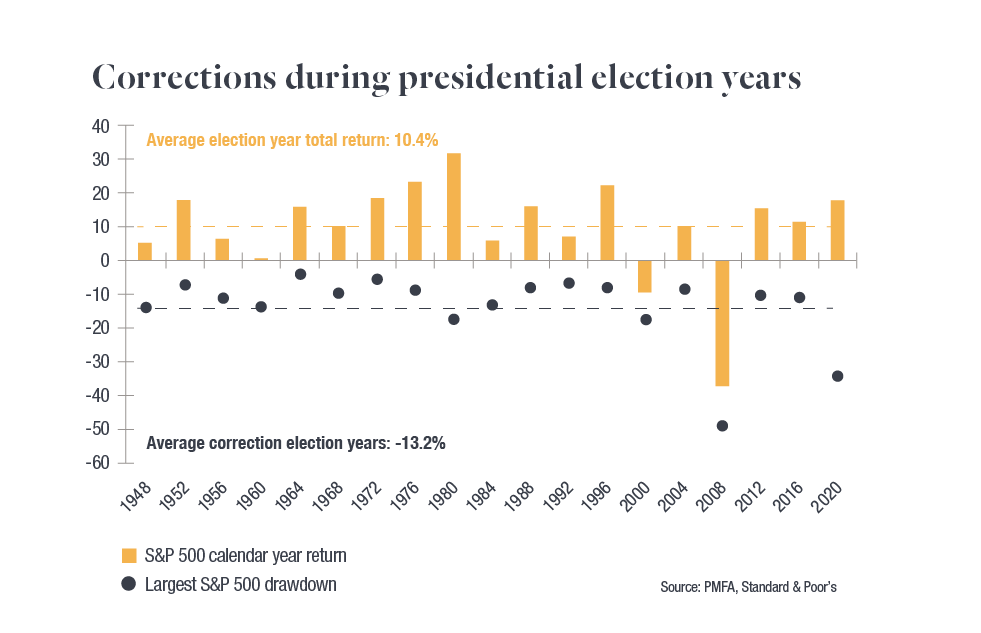

Presidential elections, on the other hand, tend to follow a different pattern, even in contentious election years. Volatility is, on average, lower during presidential election years than in non-election years. Of course, there can be turbulence, with an average market correction in presidential election years of -13.2%. Yet, by an election year's end, the market is generally on the positive side of the ledger.

Since 1948, we have only had two years of negative returns in presidential election years. Those years? 2000 and 2008. Those declines were not because of political upheaval, but rather the tech bubble bursting in 2000 and the Great Financial Crisis in 2008. If you strip out the outliers of 2000, 2008, and 2020, the average drawdown is less than 10% and the average annual return is 14.4%, which is well above the long-term stock market average annual return of 10%.

Why are these trends so different between mid-terms and presidential election years? Timing.

During mid-terms, the second year of a presidential term, the president’s policies and initiatives are just getting up and running, and change is never as smooth as we would like. In year four, all policy changes have been made and the sitting president is generally in job preservation mode, trying not to rock the boat and instead looking to encourage and support the stability of the economy.

Why would they do this? Because the economy is one of the strongest predictors of a president’s reelection chances. No president has ever been reelected when a recession occurs in the fourth year of presidency. It’s in a sitting president’s best interest to advance pro-growth policies in an election year, which helps to limit market volatility.

Markets Are Politically Agnostic

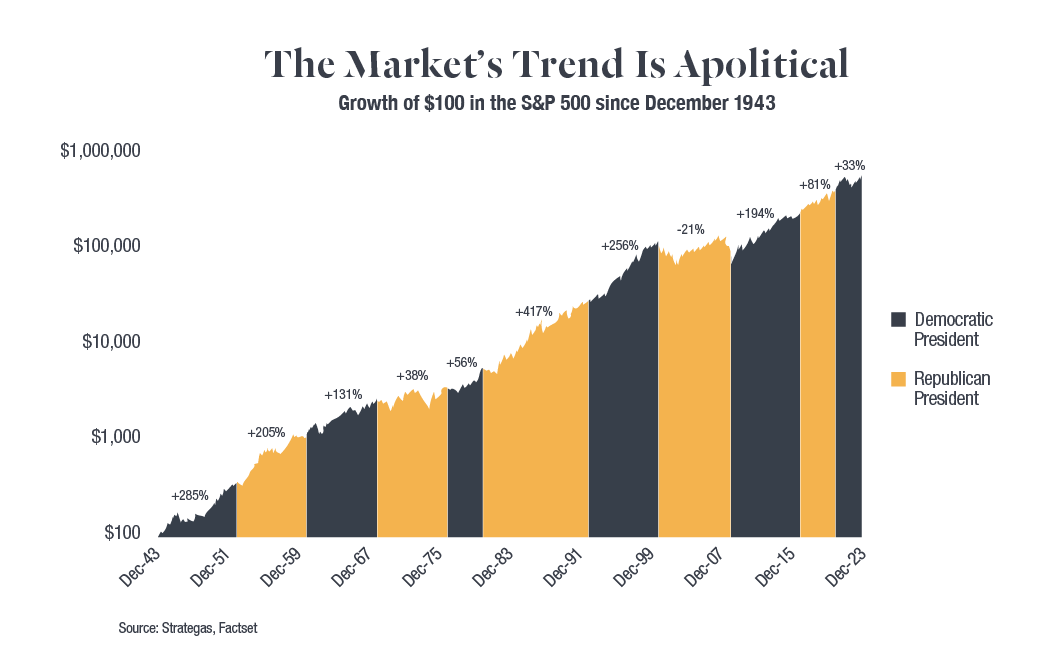

The market does not have a political leaning or affiliation. Red, blue, or any other hue that could find its way into the Oval Office, the prevailing trend of the stock market continues to be up and to the right.

The political party in power has less effect on the market than you might expect. Outside of unforeseen “black swan” events like the 2000 tech bubble, the 2008 financial crisis, or the 2020 pandemic, markets tend to take off after elections, and their long-term growth has consistently been apolitical.

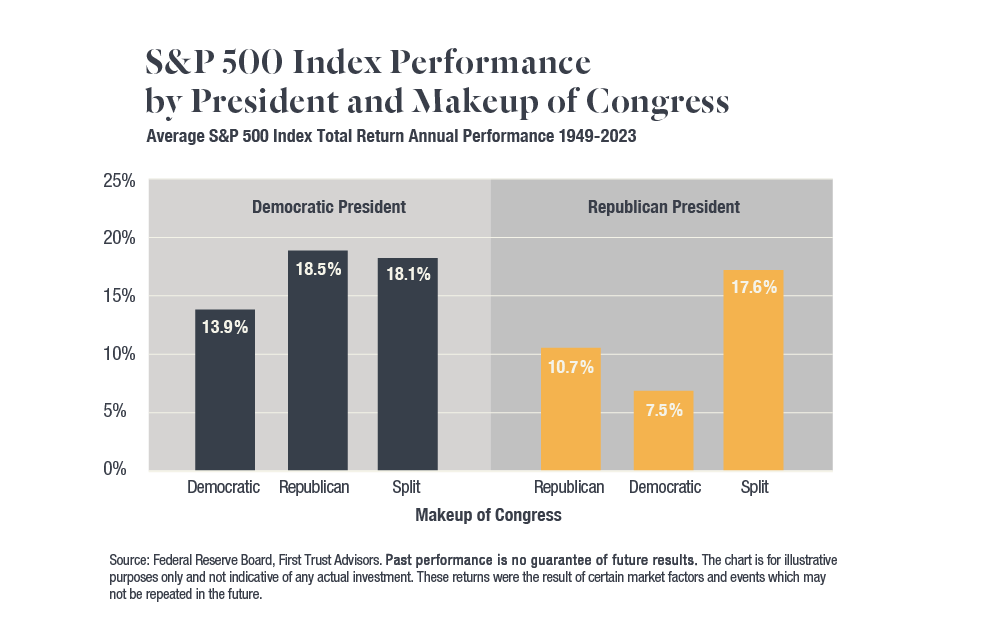

One noteworthy tendency of the market is that it prefers the status quo and predictability. The less likely things are to change, the more stable the market performance tends to be. This is why markets love political gridlock. After the dust settles this November, keep an eye on the makeup of Congress relative to the executive office. Markets have performed best with a split Congress:

Source: First Trust Client Resource Kit

With divided power in Washington, sweeping legislative changes are less likely to be pushed through. The less that changes politically, generally the better for markets.

Investing Wisdom

“This year is different,” is a sentiment we’ve heard from many of our clients as they grapple with concerns surrounding the election. That may be true. But if we are honest, every election is different in some way. No two are alike. However, the patterns we’ve explored above have held steady through decades of international wars, political turmoil, social unrest, and all kinds of difficult periods in America’s history.

None of us can predict the future with any certainty. The years that have notably broken the trend are years marked by unpredictable crises. Unless you know the timing of the next global disaster, attempting to speculate will certainly make you anxious—but it won’t help your portfolio.

Our advice leading into the election comes directly from scripture: “Do not worry about tomorrow, for tomorrow will worry about itself. Each day has enough trouble of its own.” Matthew 6:34 NIV.

When we get preoccupied with what could happen in the future, our emotions can cloud our judgment. All of your investment decisions should be made to support your unique financial plan based on your goals and values. Maintaining an objective, long-term perspective is key, especially when emotions are running high.

If you would like help creating your own financial plan or designing your investment strategy during this election season, one of our JMA Financial Planners can help. We serve generous, successful families all over the country. Simply contact our team to set up your introductory call.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.