Understanding the Federal Deficit

Share This Insight

Is the government spending too much? How much should we as citizens be concerned about our nation’s debt? These are common questions and discussions when it comes to the federal deficit, and they’re worth asking.

Deficits can serve as tools for economic stimulation during downturns. But persistent and growing deficits can raise concerns about long-term fiscal sustainability.

An overreliance on debt can be a concern at both personal and national levels. As Proverbs 22:7 cautions, “The rich rule over the poor, and the borrower is slave to the lender.” For households and nations alike, prudent financial stewardship is always the wisest path.

What Do We Mean by Deficit?

To understand the broader conversation around government spending and the economy, it's important to clarify two related but distinct terms: the federal deficit and the federal debt.

- The federal deficit occurs when the government spends more money in a given fiscal year than it collects in revenue (primarily through taxes). It is a measure of annual shortfall.

- The federal debt, on the other hand, is the total amount the government owes over time, resulting from the accumulation of past deficits minus any surpluses.

Think of it like a household budget: if you spend more than you earn in a year, you run a deficit; the debt is the total balance on your credit card from years of overspending.

In years where the government spends an amount equal to its revenue, we say the budget is balanced. Sometimes, the government operates at a surplus, actually bringing in more revenue than it spends. A government surplus is fairly rare; the last time the U.S. ran a budgetary surplus was from 1998 to 2001. Over the past two decades, the deepest deficits have coincided with national emergencies like The Great Recession and the COVID-19 pandemic, when government spending was used to curtail widespread economic decline.

What Does the Deficit Look Like Today?

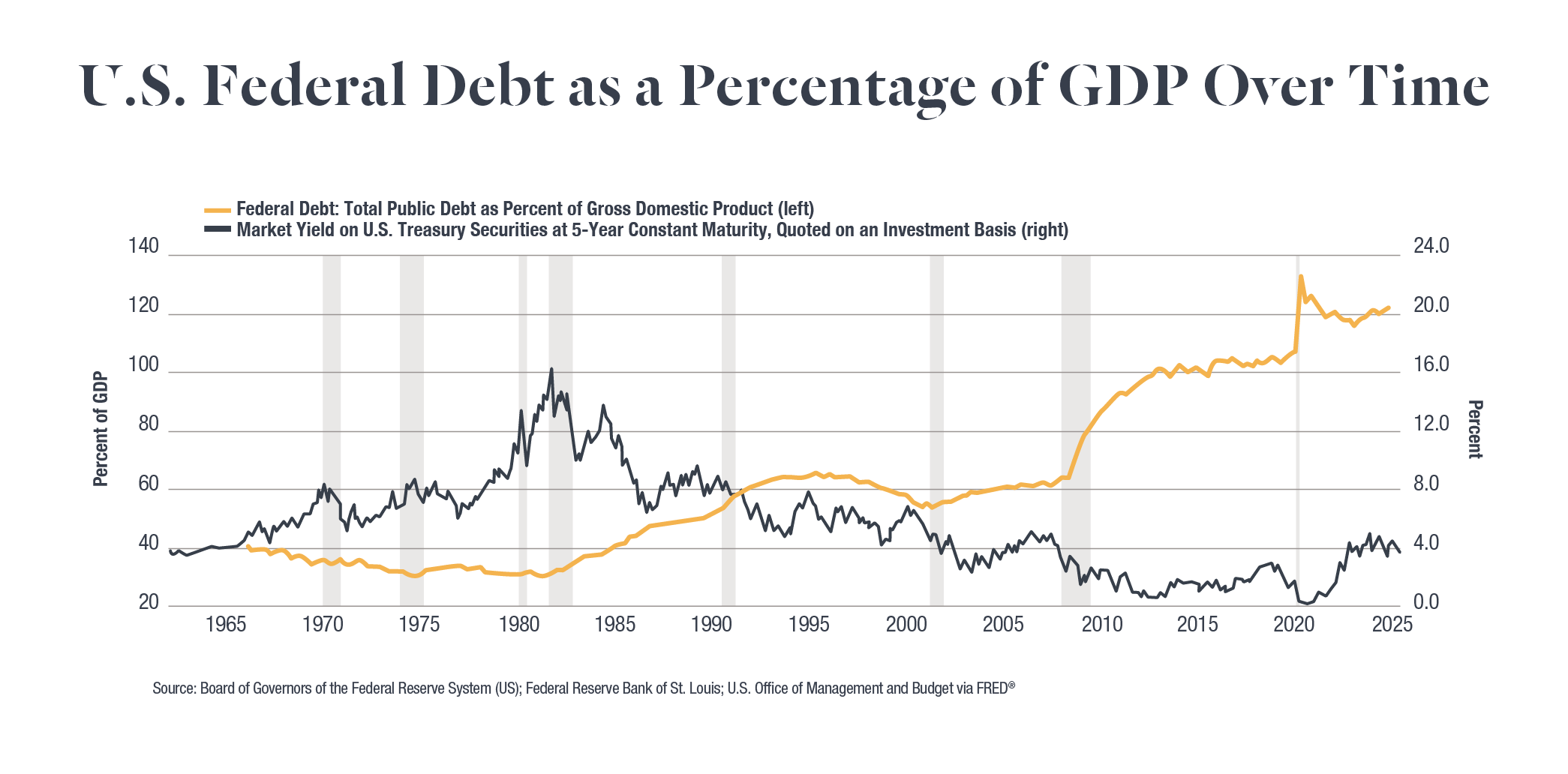

As of December 2024, the U.S. federal debt stood at approximately 121.85% of GDP, a sharp rise from past decades due to consistent budget shortfalls. Notably, the federal deficit remained very high in 2024 despite a robust economy and historically low unemployment, highlighting structural fiscal challenges beyond cyclical economic factors.

How Deficit Spending Stimulates the Economy

In the short term, running a deficit can be a strategic economic tool. During recessions or periods of slow growth, governments may intentionally spend more than they collect to inject demand into the economy, boost employment, and prevent deeper downturns. This is often done through tax cuts, stimulus payments, or infrastructure spending. These measures aim to stimulate consumer spending and business investment, which in turn helps revive economic growth.

However, such stimulus must be used wisely, as unchecked deficit spending can lead to future fiscal imbalances.

Efforts by the Department of the Treasury and the Office of Management and Budget (OMB), including targeted reductions in discretionary spending and debt ceiling negotiations, illustrate attempts to rein in the deficit while balancing growth needs. Still, these efforts remain politically and economically complex.

Why the Federal Deficit Matters to Families

According to a study by World Bank, countries with a significant and prolonged debt-to-GDP ratio often experience economic slowdowns.

These unchecked deficits can lead to broad, tangible impacts for American households:

- Rising Interest Rates: Increased government borrowing competes with private demand for capital, potentially pushing up rates on mortgages, student loans, and credit cards.

- Higher Taxes or Reduced Services: To manage growing debt, future policy may require tax hikes or cuts to programs like Social Security, Medicare, education, and infrastructure.

- Inflation Risk: Long-term borrowing may fuel inflation, eroding purchasing power—especially painful for lower- and middle-income families.

- Economic Instability: Eroding investor confidence in U.S. fiscal management could spark market volatility and affect retirement portfolios.

While federal deficits can be instrumental in addressing immediate economic needs, they can also have a long-term impact. Balancing short-term economic support with long-term fiscal responsibility is essential to economic stability and the continued provision of government services.

Scripture reminds us of the consequences of excessive debt and the wisdom of sound stewardship. Just as individuals are called to live within their means, so too must nations exercise discernment in managing their financial obligations.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.