Finding Balance in Your Goals and Priorities

Share This Insight

Recently, I met with a young couple who had just welcomed their first child. Many families in their position end up overwhelmed by all the new decisions in front of them, financial and otherwise. But these two were in an unusually flexible position: They were already beginning to save for their child’s education, planning ahead for future expenses, and thoughtfully weighing how today’s choices affect tomorrow.

What was it that put them in such a strong position as new parents? Did they have some unknown superpower or hidden advantage over the rest of us? Not really. They simply began thinking early about the long-term and taking actions toward it that would set them up for success. By ingraining diligent savings habits right away, they were able to contribute to retirement accounts, aggressively pay down their mortgage, and set themselves up for greater clarity and freedom rather than financial stress.

This kind of forethought isn’t easy. Most of us struggle to imagine life 40 years down the road when today is cluttered with worries about student loan debt, purchasing a home, buying a bigger car for a growing family, paying for private school for the kids, pursuing a second degree to increase earning power, or try to squeeze a few dollars into a 401(k). It’s overwhelming. It feels easier to just not think of the future than try to juggle all of that at once.

But the less we think ahead, the less we’re able to think ahead. It’s a never-ending cycle.

Fortunately, it’s a cycle that can be broken, as the young couple I met with prove. It’s not a matter of being super-powered or privileged. It’s an issue of prioritizing our goals and actions based on our values—not just a sense of urgency.

What is Prioritization, and Why is it so Hard?

No one can do everything, so we all prioritize every day. The question is, are we prioritizing based on what matters most, or just what looks easy, glamorous, or fun?

Wise prioritization requires looking hard at your values and cultivating a larger perspective. The Bible encourages us to adopt a long-term perspective, one that extends far beyond retirement or funeral arrangements. Jesus tells the story of a rich man who decided to tear down his barns and build bigger ones for his ever-increasing crops so he could “relax, eat, drink, and be merry.” God responded, “Fool! This night your soul is required of you, and the things you have prepared, whose will they be?” (Luke 12:16-21). The “rich fool” in the parable was thinking ahead, just not far enough.

Prioritization entails more than just serious reflection, though. It also requires overcoming common “roadblocks” that tend to get in the way. Here are three common examples:

- Delayed Gratification is Hard: It's more emotionally satisfying to save for an Atlantic cruise this summer than for retirement decades away.

- All-or-Nothing Thinking: It can feel easier to put everything towards one goal at a time, but a financial plan usually has multiple competing goals. I once met with a client who was saving almost his entire paycheck. While his self-discipline was impressive, he was putting all his savings into retirement accounts and had virtually no emergency fund. He was, oddly enough, avoiding planning ahead by defaulting to 401(k) savings.

- The Trap of the Urgent: In a study published in the Journal of Consumer Research, researchers found that when people are faced with both urgent and important tasks, they tend to focus on urgency over importance—even when the important task provides greater long-term rewards. The "Mere-Urgency Effect" can skew not only our time management but also our financial strategy.

Each of these pitfalls keeps us focused on the short term, making it harder to build long-term stability and purpose with our finances. That’s why having a thoughtful, intentional process matters.

A Simple Process for Balancing Goals

Here’s a framework to help navigate competing priorities and stay grounded in what matters most:

Set Your Goals Thoughtfully

Begin by reflecting on your values and setting goals accordingly. Make sure each goal includes a timeframe, dollar amount, and purpose.

Categorize by Time and Importance

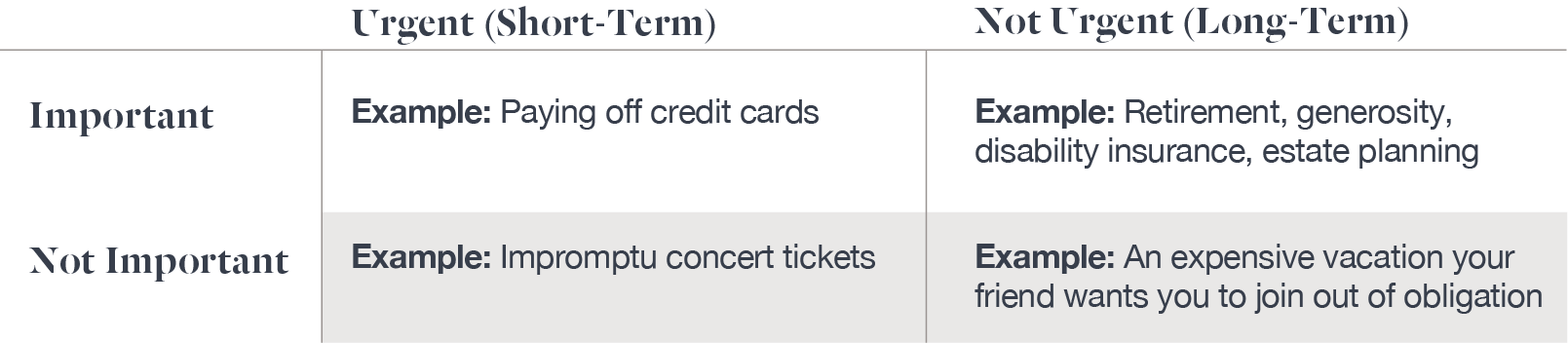

Categorize your goals to identify not just what matters, but when it matters. You can use a framework like the Eisenhower Matrix, which was designed as a time-prioritization tool but can also be applied to your finances:

Build Habits to Work Towards your Long-Term Goals

Look at your long-term, important goals. Ask yourself, “What habits do I need to develop to meet my goals?” Long-term goals typically require small daily sacrifices, not spontaneous savings binges. Want to grow in generosity? Set up a giving account with $10/month. Saving for retirement? At a minimum, contribute enough to get your 401(k) match.

Meeting Your Goals

Once you’ve started a habit, you can work on determining an appropriate savings rate to meet your goal within the desired timeframe. There are many financial calculators available on the internet that can help you do this, or you can connect with a financial advisor for more personalized help.

Here are a few more tips to keep in mind:

Be Strategic with Short-Term Goals

Now look at the short-term, important goals. For more immediate needs, liquidity and security are key. Avoid investing aggressively for goals like home down payments or car purchases within the next few years. And don’t underestimate the importance of an emergency reserve. It may not be as exciting as saving for your dream vacation, but it’s one of the most important priorities because life is unpredictable.

Evaluate Tradeoffs

Next, allocate excess cash flow to your less important goals. You may have to forgo or defer some of these goals to meet the more essential ones. Generally, the earlier you begin planning, the less you’ll have to compromise. For instance, if you begin saving for your next car as soon as you purchase your current one, you can spread out the savings and avoid shortchanging your house savings fund. The key is to make as many of your goals as possible long-term by building the habit of thinking ahead.

Balancing short-term and long-term goals can be challenging. However, if you take the time to develop a long-term perspective, understand your values, and prioritize your goals accordingly, you will approach your financial decision-making with greater confidence.

That’s why prioritizing should be a top priority. It takes some effort, but it makes everything else easier. If you need help planning your financial priorities, a JMA financial advisor can help you understand your options and create a plan that works for your family.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.