Four Investing Pitfalls to Avoid

Share This Insight

Investing is one of the most powerful financial tools available for growing wealth, but it’s not magic. You have to approach it carefully and with a plan if you want to get the most from your investments. As a young person or someone just starting out on your financial journey, here are a few of the most common pitfalls and mistakes to avoid.

Putting All Your Eggs in One Basket (or None at All)

The key to success with investing is a well-balanced, diversified portfolio. That way, if some of your investments underperform, others can pick up the slack.

Here are a few investment types you should familiarize yourself with:

- Stocks: A stock is a partial ownership stake in a company. When the company does well, you do well. These are riskier investments but have higher potential returns.

- Bonds: Private and government bonds are a way for you to “loan” some of your money to someone else. It’s then paid back with interest. This is a safer way to invest but tends to have a lower return.

- Alternative Investments: These include gold, real estate, commodities, and cryptocurrencies, to name a few. Each of these operates by its own rules, so you’ll want to explore the specifics of what you’re looking to invest in, but they can round out a portfolio with diversification.

- Cash or Cash Alternatives: For short-term goals, putting cash in a savings account or money market can provide a small yield while keeping some liquidity so you can access funds if you need to.

Beginners are often intimidated and overwhelmed by their options, leading them to make just one type of investment or else avoid it altogether. But taking a bit of time to understand your options can help you make an investment strategy that brings you closer to your goals.

Falling for Get-Rich-Quick Schemes

Some people view investing as a shortcut to riches. They might speculate in cryptocurrency or startups in hopes of making a quick profit. They may even struggle to keep a job, planning instead to “hit the jackpot” with a runaway investment profit.

This type of speculation is more like gambling than investing. Unfortunately, it’s easier than ever to fall into this scheme thanks to gamified investing apps and online communities that can feed into the addictive cycle.

You’re more likely to lose money on a high-risk investment than to build wealth. It’s much safer to build your wealth slowly, becoming a millionaire paycheck-by-paycheck. Consistent earnings and healthy financial habits will add up over a lifetime.

Making Money Itself a Goal, Not a Tool

Gathering wealth for its own sake can become unhealthy. If you’re chasing a number, it’s easy to fall for a get-rich-quick scheme or to have unrealistic retirement goals. If you remember that wealth is simply a tool for reaching your goals, you can put things into perspective and focus on the process instead of falling victim to greed.

So, instead of being a trader, think like an investor and tie your choices to your goals. For example, for short-term goals, invest in safer vehicles like bonds or cash. For longer-term goals like retirement, you can mix in more stocks. A 401(k) retirement plan usually has a target date for retirement, and the mix of stocks and bonds will change to become more conservative as you approach that date. We’ve written more about goals and investment planning here.

Procrastinating

Putting off your retirement planning and other investments is one of the biggest mistakes you can make. Thanks to the power of compound interest, the sooner you start, the more potential growth you might achieve.

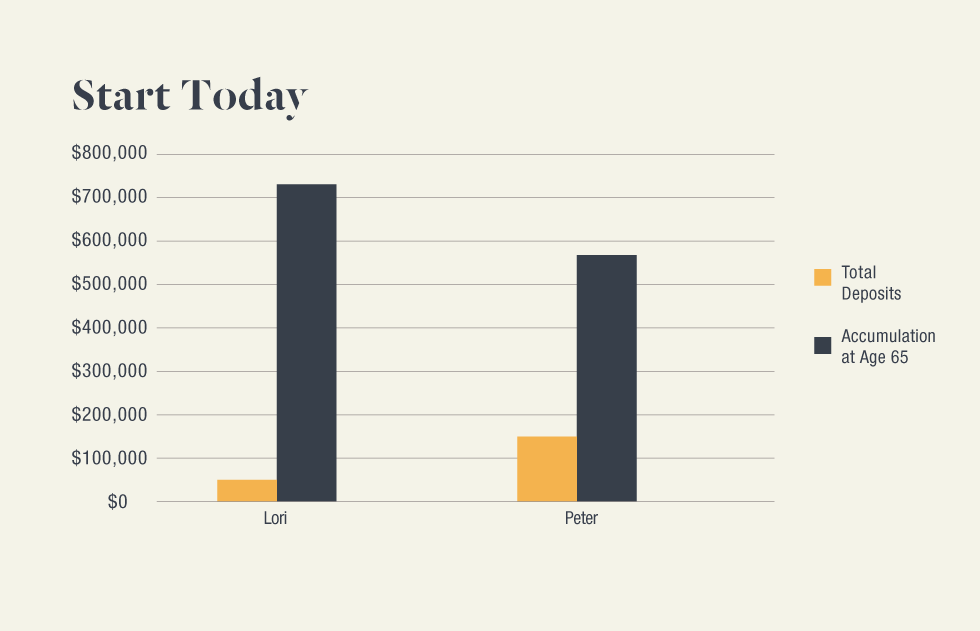

Consider this example:

- Assume a reasonable rate of return, normal raises, 80% wage replacement ratio, and social security benefits.

- Both Lori and Peter saved $5,000/year and earned an annual 8% return.

- Lori saved from 25-34, then stopped. She invested $50,000 total and ended up with $728,867 at age 65.

- Peter saved from 35-65. He invested a total of $150,000 and ended up with $566,416 at age 65.

(Source: Retirement Planning and Employee Benefits, Money Education)

Investing early doesn’t mean a life of austerity and deprivation. It just means remembering that any money you spend today, can’t be saved for your future. We often say that delayed gratification is the greatest sign of financial maturity. If you can find alternatives to instant rewards today, you put yourself in a better position to reap more rewards later—including the psychological and spiritual rewards of self-control.

We recommend allocating at least 10% of your income, including any employer match, toward retirement. Savings for other goals, like a home or starting a family, should be budgeted separately.

How to Get Started Investing

The best way to avoid procrastination is simply to begin. Starting with an automatic payroll deduction and contribution to your workplace’s retirement account is a great first step. You can also use an app or “robo advisor” to help you make simple investments. Just be sure to avoid speculation and anything that sounds too good to be true.

Another idea is to consult with a money mentor who you trust to help you figure out some goals and make a plan for reaching them. If there isn’t someone in your life who can fill that role, consider scheduling an appointment with a financial advisor.

You don’t need to have them manage your investments for you, especially if you just have a small account. But a one-time consultation can help set you on the right path and serve as a powerful investment in your financial future.

Subscribe for More Financial Insights

Never miss a post. Receive notifications by email whenever we post a new JMA Insight.